Recommended

Yacht owners on st. barts track locations of crew to keep covid at bay.

- View Author Archive

- Email the Author

- Follow on Twitter

- Get author RSS feed

Contact The Author

Thanks for contacting us. We've received your submission.

Thanks for contacting us. We've received your submission.

As the rich and famous flocked to their yachts on St. Barts this holiday season, many of them did everything they could to prevent the spread of COVID-19 — including tracking the location of crewmembers to make sure they stayed onboard, On The Money has learned.

Yachts provide a fair amount of isolation and privacy for those who can afford it — but that’s only if everyone else on board is also committed to isolating and staying away from possible super-spreader events.

So, amid a surge in Omicron cases, the ultra-rich clamped down on crewmembers’ usual visits to shore. Captains told staff — including chefs, deckhands, and first mates — they had to stay on the boat and share their location on their cell phones, one source who was recently aboard a big boat told On the Money.

Some Russian oligarchs are said to have taken an even harsher position than their American counterparts, the yacht-goer told On the Money, and required crew members to wear ankle bracelets like criminals under house arrest.

But staying away from the posh St. Bart’s nightclubs proved too difficult for some crew members. To avoid surveillance, one trio of staffers left their phones on board when they went ashore in the middle of the night, a source told On The Money.

Their escape was only discovered when the owner of the yacht woke up hungry for a pastrami sandwich at 3 a.m. When he couldn’t find the chef, he asked the captain to find him. But the three crew members — including the chef — had left their phones on board to avoid being tracked ashore. When they found their way onboard after a night of partying, they were forced to quarantine — unpaid — for five days, this person adds.

Yachts have proven a favorite — albeit controversial — escape for the wealthy since lockdowns began in 2020.

At the outbreak of coronavirus in March 2020 billionaire David Geffen — famous for his nearly $600 million superyacht — sparked outrage when he posted an aerial shot of his boat and said he was isolating in the Grenadines.

“I’m hoping everybody is staying safe,” Geffen wrote from his 454-foot boat named Rising Sun.

While billionaires may have learned to be more subtle since then, their concern with avoiding COVID seems to have remained.

Blackstone Group billionaire Stephen Schwarzman, who is known for his lavish birthday bashes, resumed hosting parties in 2021 — albeit with safety measures in place, On The Money has learned.

In November, prior to the Omicron outbreak, Schwarzman invited pals to a soiree in St. Barts. But he didn’t trust the island’s already stringent testing protocol, a source familiar with the matter told On the Money. He flew out a team of his doctors to separately test all the patients.

Share this article:

Yachts, parties and private islands: The indulgences of real estate’s richest

From floating mansions to private Drake performances, here's how the industry's 1 percent spend their millions

R e member the bad old days in New York? The 1970s had the city on the precipice of fiscal ruin, but a mouthy tax attorney named Steve Ross bet big on the metropolis that many landlords were ready to give up on.

R oss’ Related Companies was part of a class of modern-day real estate titans that would emerge from those ashes, but once you’ve transformed the skyline of a city often described as the capital of the world, what else is there to do? With a net worth of $4.5 billion and a place in real estate lore, Ross thought he’d buy himself a football team.

A decade after Ross spent more than $1 billion to acquire the Miami Dolphins, America has entered a new era of property titans. Real estate’s elite have always loved shiny toys and flashy parties. Now, some of the richest among them are turning the world into a playground for the ultra-wealthy.

Y ear of the yacht

I n the rich folks’ toy box, the superyacht is nothing new. What is new is an unprecedented surge of purchases. Some 887 of them were sold last year, almost double the number sold in 2020, leaving the wealthy to contend with a shortage and seemingly endless waiting lists.

B ut before taking a look at the boats of the yachted gentry, let’s consider the yachtless among us — including Linda Macklowe, who lost hers in her divorce from 432 Park Avenue developer Harry Macklowe.

W hen the former couple couldn’t agree on the value of their art collection, accrued over the course of their marriage, a judge decided it should be auctioned off. After the second round of bidding in May, it brought in a record $922.2 million.

Y ou can split money in half. You can’t split a boat. Long rides on the yacht, named “Unfurled,” were once a passion the Macklowes shared. “Unfurled“ now belongs to Harry.

W hile some go for the latest and greatest, luxury spec home developer Todd Michael Glaser’s tastes skew more vintage. Glaser and his 62-foot “Sea Tabby,” built in 1938, have been together for nearly 12 years. It still has all the original furniture, along with three state rooms and a full kitchen.

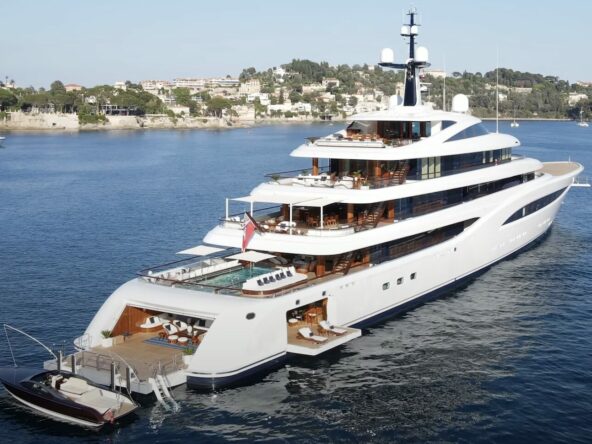

F lorida kingpin Jeffrey Soffer is willing to share his superyacht, “Madsummer” — for $1.6 million a week, according to a rental listing. NFL legend Tom Brady and his supermodel wife, Gisele Bundchen, were spotted on it last year.

A t that price, “Madsummer“ may be the superyacht to end all superyachts. It boasts a beach club, helipad, daycare center, spa and indoor and outdoor cinemas — a “floating mansion” in every sense of the word.

O stentatious bashes and personal playgrounds

B rady hasn’t just taken Soffer’s yacht for a spin — he’s next-door neighbors with the developer on Indian Creek, a 300-acre Miami island where other high-profile residents have included models Adriana Lima and Soffer’s ex-wife, Elle Macpherson, as well as Ivanka Trump and Jared Kushner.

O racle co-founder Larry Ellison is playing landlord to the people of Lanai, the Hawaiian island he bought 98 percent of in 2012 for $300 million.

E llison moved to Lanai full-time during the pandemic, and he’s quickly turning it into a playground for other big-name billionaires such as Elon Musk and Tom Cruise, who fly or sail in, coming and going as they please.

E llison also owns Lanai’s grocery store, gas station, newspaper and the Four Seasons resort, which employs most of the island’s population.

Sign Up for the undefined Newsletter

E xpensive boats and private islands are nice, but there’s nothing like a party. Anyone in the industry can tell you that real estate wealth shines most when the elites put on a night to remember.

N ew York retail magnate Jeff Sutton reportedly spent $25 million on his daughter’s wedding in Puglia, Italy, including $5 million on chartered jets to transport guests (Editor’s note: Sutton claims it was $12 million for the wedding and $1 million for air travel). When the big day came, the billionaire father of the bride made a grand entrance in a horse-drawn carriage.

F or his daughter’s bat mitzvah at the Rainbow Room in 2016, developer Ben Ashkenazy hired rapper Drake, who performed his then-hit song “Hotline Bling.”

T he old guard and the new

Cars aren’ t just a way to get from A to B. Glaser loves his antique cars, especially his old Ferrari and Land Rover, and he relishes early morning drives on the weekend.

B lackstone CEO Stephen Schwarzman, who said his father was always happy with just two cars, has a Porsche 911, an Audi A4, a Mini Cooper and a BMW 645 CI that goes from 0 to 60 in 5.6 seconds.

T hese collections are impressive to most, but they’re modest compared to that of Southern California real estate tycoon and social media sensation Manny Khoshbin.

T he Khoshbin Company specializes in retail and office properties, although you wouldn’t know it from Khoshbin’s internet presence. The super car connoisseur’s YouTube channel is all automotive content, the thumbnails a gallery of his many expensive rides — s o many, in fact, that l ast year he bought a 70,000-square-foot p roperty to store them.

T he “House of Khoshbin” is a palatious monstrosity of mirrored walls, Roman columns and gilded murals of cherubs on every floor. The garage is still unfinished, but it will house Khoshbin’s Bugattis, Porsches and the rest of his fleet.

I n an industry where showy displays of wealth are the norm, fleets of sports cars or superyachts make for a great flex. But some billionaires prefer not to showboat.

W est Coast developer John Sobrato, who spends up to 18 weeks out of the year on his yacht, said he sees it not as a luxury asset but as an extension of his home.

“ We’ve had the same boat now for 17 years, which is unheard of in the industry,” he told the Nob Hill Gazette in a 2019 interview.

L arry Silverstein’s elusive, 175-foot “Silver Shalis” tends to generate local headlines when it makes a rare appearance. It was spotted in Maine last summer, and it popped up in Fort Lauderdale in January.

T he “ Silver Shalis ” is an oasis of luxury, with a glass elevator, a swimming pool, a dining area and an art collection. Silverstein purchased it in 2010, reportedly for more than $30 million.

A sked by TRD about the yacht’s price in a 2011 interview, Silverstein demurred.

“ That’s irrelevant,” he said.

Pandemic Lifestyles of the Rich and Famous

While millions suffer from the COVID-19 pandemic and economic disaster, America’s billionaires are retreating to their luxurious enclaves and super yachts as their wealth soars.

Billionaire David Geffen’s $590 million super yacht, Rising Sun (Image: reivax, Flickr )

Everyday, it becomes clearer: the COVID-19 pandemic is hitting poor, working, and marginalized communities the hardest.

Millions of workers – especially low-wage retail, food service, hospitality, and care workers – have faced the terrible choice daily between going to work and risking their health, or staying home and risking their paychecks. Many other workers don’t even have that choice, with around 30 million people in the US filing for unemployment in the past six weeks.

But billionaires don’t face these same problems. As tens of millions have lost their jobs over the past two months, billionaire wealth soared by a whopping $282 billion between March 18 and April 10, according to a new study from the Institute for Policy Studies. And while finding enough space to wait out the pandemic is something many struggle with , billionaires have been escaping to their second (or third, or fourth) homes to ride it out in luxury – all while they position themselves to further profit off of this crisis.

Clearly, the COVID-19 pandemic is not the “ great equalizer ” that some predicted.

Here, we look at how some billionaires – hedge fund managers, real estate developers, etc – have taken to social distancing in wealthy enclaves like Palm Beach and the Hamptons – and of course, their super yachts.

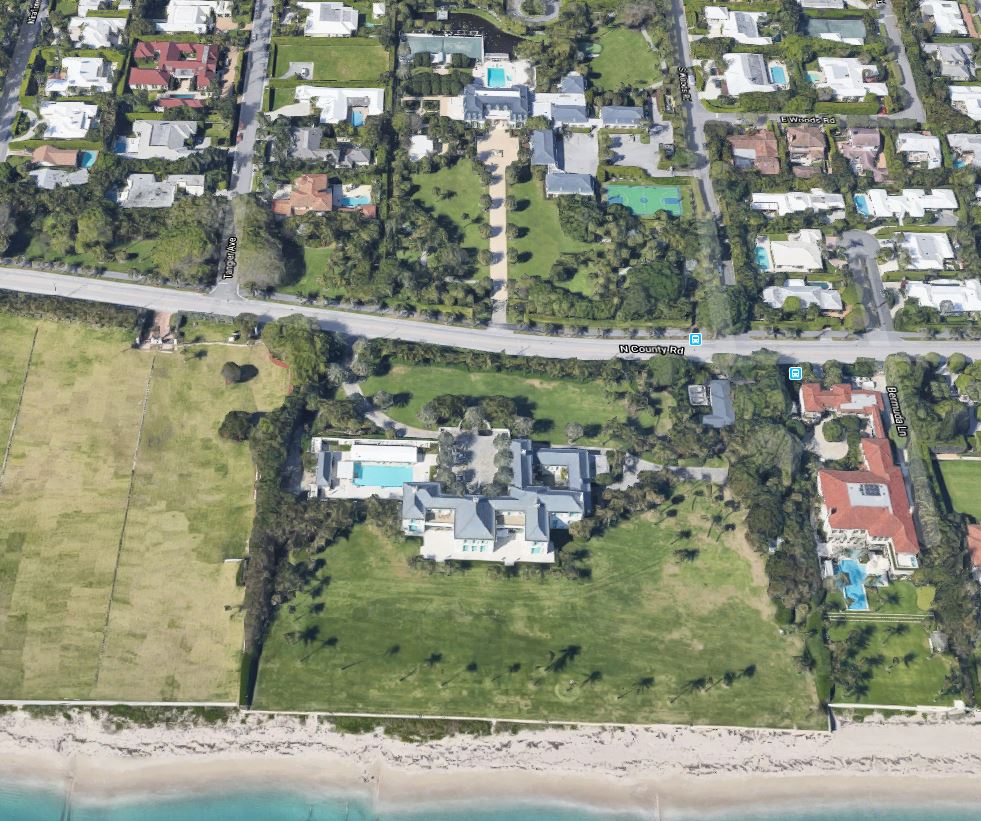

Palm Beach, Florida

If you want to see a quintessential billionaire enclave, look no further than Palm Beach, the 18-mile Florida island, sitting on the rim of the Atlantic Ocean, home to a slew of private equity and hedge fund executives.

Palm Beach was recently in the news when the New York Times reported on April 7 that hedge fund billionaire Ken Griffin “secured sumptuous Florida quarters” for stock traders from Citadel Securities – a “sibling” to his hedge fund, Citadel – to hunker down in: the five-star Four Seasons hotel in Palm Beach (where some rooms are currently priced at up to nearly $3,000 a night).

Citadel Quarantines at the Four Seasons Palm Beach to ride out the storm! https://t.co/OZ5V9DivTW — Alison Galardi (@alibrite) April 8, 2020

Griffin, worth $12.5 billion , recently purchase d a $99 million Palm Beach estate to bring his total Palm Beach holdings up to $350 million.

For Griffin, this is just a small slice of real estate empire. He owns the most expensive homes in both Miami and Chicago (where his hedge fund is based), and he bought a $122 million mansion in London – the priciest home sold there over the past decade. In 2018, he bought the most expensive home ever sold in the US – a $238 million New York City penthouse. It was the cherry on top of what CNBC called Griffin’s “$700 million global real estate shopping spree, believed to be the largest ever for a U.S. billionaire.”

If that wasn’t enough, Griffin also paid $500 million for just two pieces of art in 2016.

Griffin owns a 17-acre space, nearly empty lot on South Ocean Boulevard, also known as West Palm’s “Billionaire’s Row.” According to the New York Post , his neighbors there include notorious Wall Street bigwigs like Stephen A. Schwarzman, Paul Tudor Jones II, and Steven Schonfeld.

Schwarzman is the head of Blackstone, the world’s top private equity firm, overseeing $571 billion in assets. Schwarzman – a political ally of, fundraiser for, and big donor to Donald Trump – is worth $17.5 billion . Tudor Jones founded the hedge fund Tudor Investment Corporation, and is worth $5.1 billion . He also sits on the board of the Palm Beach Civic Association, alongside a slew of elites, including Trump allies Rudy Giuliani and billionaire Stephen Ross.

Another hedge fund billionaire, Steven Schonfeld, recently paid $200 million to buy Palm Beach’s most expensive mansion.

But back to Griffin. When fellow billionaire Jeff Greene – a developer who is Palm Beach’s top landowner – heard about how Griffin put up his stock traders at the Four Seasons, he “fired off emails to his contacts in the financial industry offering hotel rooms for alternate trading sites of their own.”

““I sent them all emails saying, ‘I have a hotel right next door. Could you use a trading floor?’”, the NYT quoted Greene.

(It should be noted that not everyone lauded the Wall Street takeover of Palm Beach’s fancy hotels. The NYT reported that a neighbor to the Four Seasons said “it was difficult not to think about the contradiction between the traders working at a five-star resort and people unable to ride out the pandemic in similar comfort.”)

Greene, worth $3.7 billion , owns a home on Palm Beach’s Billionaire’s Row near the likes of Schwarzman, Tudor Jones, and Schonfeld. He made a big chunk of his fortune off the 2007-8 housing crash: “[Greene’s] biggest win came when he bet that the subprime mortgage bubble would burst,” wrote the Palm Beach Post . “In 2006, Greene bought credit default swaps that he later cashed in for a profit of $500 million to $800 million.”

Greene also spent tens of millions on failed U.S. Senate and gubernatorial Demoractic primary runs in Florida.

Greene’s properties stretch beyond Palm Beach. In 2014, he listed for sale a $195 million, 53,000-square foot Beverly Hills mansion that included “25 private acres, a 3,000-bottle wine cellar, a bowling alley, a state-of-the-art theater, a vineyard and much more.”

Astonishingly, Greene declared in 2015 that “America’s lifestyle expectations are far too high and need to be adjusted so we have less things and a maller, better existence.”

A host of other billionaire investors have second, third, or fourth homes in Palm Beach. Nelson Peltz, who heads up the hedge fund Trian Partners, owns a $136.4 million oceanfront estate (it’s called “Montsorrel”). Peltz, whose hedge fund portfolio includes Wendy’s and P&G, recently hosted the priciest-ever Trump reelection fundraiser there. The New York Post reported that Peltz is looking to cash in on the current crisis.

Henry Kravis, who co-founded the private equity firm Kohlberg Kravis & Roberts, is also a big name in Palm Beach. When he’s not raiding and bankrupting children’s toy stores , Kravis, worth $5.6 billion , can visit Palm Beach’s Kravis Center for the Performing Arts, named in honor of his father , Raymond Kravis. Kravis also sits on the board of the Palm Beach Civic Association.

In addition, the wealthy CEO of the Mount Sinai Health System and the president of the Mount Sinai Health Network took some heat for social distancing from their homes in Palm Beach while their hospital system in New York City “ seems to be imploding ” under the weight of the coronavirus pandemic.

The Hamptons

The Hamptons, on the eastern end of Long Island, is a storied vacation spot for New York City’s rich and famous. Despite only being April, these elites have been clamoring to leave the city to escape the spread of coronavirus and hunker down in the luxury of – what are typically – their summer homes.

One peninsular stretch along Meadow Lane in Southampton, NY has long been dubbed “ Billionaire Lane ” for its concentration of high dollar beachfront properties and wealthy residents. The area, which Curbed called “where the 1% of the 1% summer,” is one of the most expensive addresses in the county and even has its own helipad to help vacationers reach their mansions even faster. A helicopter commute from Manhattan only takes 40 minutes.

Residents of “Billionaire Lane” have included Wall Street bigwigs, CEOs, celebrities, and the late David Koch. Billionaire hedge fund manager Daniel Och vacations on a four acre estate worth $26.5 million, while fellow hedge fund billionaire Chase Coleman owns a five acre estate worth $32.5 million.

Private equity billionaires Leon Black and Henry Kravis (yes, that same Henry Kravis from the Palm Beach section above) each own several acres of oceanfront property, while Loews CEO James Tisch of the billionaire Tisch family purchased the famous 8,000 square foot home featured in the film “ Something’s Gotta Give ” for $41 million.

The Hamptons’ Billionaire Lane: Where Wall Street’s richest retreat for the summer. http://t.co/3ekZOV9XEP pic.twitter.com/Njzupoajz3 — ForbesLife (@ForbesLife) June 19, 2014

The strip is also a second home to several celebrities, including designer Calvin Klein who tore down one mansion to build a new $75 million one more in line with his style, and Studio 54 co-founder and hotelier Ian Schrager who has owned his four acre property since the 80s.

Indeed the Hamptons are so famously connected to wealth and privilege that the destination was name-dropped in a viral appearance by Chamath Palihapitiya, founder and CEO of Social Capital, on MSNBC as he railed against bailing out billionaires and hedge fund managers:

“Who cares? Let them get wiped out. Who cares? They don’t get to summer in the Hamptons? Who cares?”

The U.S. shouldn’t bail out billionaires and hedge funds during the coronavirus pandemic, Social Capital CEO Chamath Palihapitiya says. “Who cares? Let them get wiped out.” https://t.co/dIbizumtqG pic.twitter.com/u8BSVvr0B1 — CNBC (@CNBC) April 9, 2020

Now, the Hamptons, already rife with the vacation homes of the 1%, are experiencing an influx of even more wealthy individuals looking to ride out the pandemic in a posh setting, taxing local resources during what is typically a slow season.

Joe Farrell, a wealthy Hamptons property developer, provided some insight into the rush of New York’s rich to find refuge when he told the New York Post that he rented a sprawling property nicknamed “Sandcastle” to a fellow New Yorker for $2 million after it was listed for just one day.

Farrell further disclosed that the six month rental, which set a new price record for the area, went to a “textile tycoon and his family who were stuck in Manhattan and wanted to leave the city on a day’s notice.” He noted that this was “a COVID situation — not a normal summer rental.”

The real estate listing for the estate reveals an astounding number of amenities, including: 10 bedrooms, 15 bathrooms, an elevator, baseball field, tennis, squash, racquetball, basketball and volleyball courts, two-lane bowling alley with full bar, a rock-climbing wall, DJ booth and recording areas, 10-seat theatre, pool and hot tub, spa suite with sauna and two hydraulic massage tables, and a skateboarding half-pipe.

While we do not know much about the “textile tycoon” who rented this estate, we can get a sense of the clientele Farrell serves from the services he offers. Farrell has several Hampton’s properties available for rent, and he boasts about flying clients between the city and their new homes in his company helicopter, or using his private jet to scoop up their stranded children. The “Sandcastle” property has been rented by numerous celebrities including Beyoncé, Jay-Z, and Justin Beiber, and was the site of a fundraiser for Donald Trump, where tickets sold for up to $250,000 each.

This rental is a window into the pampered opulence the wealthy expect to maintain in the midst of a global pandemic. However, year-long residents of the Hamptons are fed up with the city elites using their towns and villages to escape, dismissing warnings, and bringing the highly contagious virus with them. The influx during the off season for the area has created major food shortages and strained the small local hospital.

Perhaps most egregious of all, the wealthy are not exactly hunkering down in their mansions once they arrive – rather, some are out partying, as if suddenly inoculated from the virus by their well-to-do surroundings.

Super Yachts

Rather than retreating behind the gates of private estates, some of the ultra-wealthy have taken to the high seas to weather the crisis on luxury yachts far away from the growing scenes of misery on the mainland.

Music and movie mogul David Geffen posted a photo to Instagram of his $590 million yacht captioned: “Sunset last night…isolated in the Grenadines avoiding the virus. I’m hoping everybody is staying safe” on March 28.”

Thanks, David Geffen, for your thoughts. pic.twitter.com/5XTRhGX5OP — southpaw (@nycsouthpaw) March 28, 2020

Outraged backlash to his post was so swift and severe that Geffen deleted his account .

Geffen, the founder of Geffen Records and DreamWorks Pictures, is worth around $8 billion. He is the wealthiest person in the entertainment industry, according to Business Insider .

The yacht where he is isolating, named Rising Sun , was originally built for Oracle founder Larry Ellison. Guests on the yacht have included Jeff Bezos, the Obamas, and a host of industry celebrities.

Geffen’s yacht, which he paid more than half a billion dollars for, even has its own Forbes page .

Forbes describes Geffen as a “luxury property aficionado” who “owns one of NYC’s most expensive apartments, a house in the Hamptons and the Jack L. Warner estate in Beverly Hills.”

He is also a huge art aficionado, having “amassed an impressive contemporary art collection, including works by Jasper Johns, De Kooning and Jackson Pollock.” Geffen has one of the most expensive private art collections in the world, estimated to be worth around $2.3 billion as of 2018 by Whitewalls , an art industry website.

(Oh yeah – that $500 million that hedge fund Ken Griffin manager paid for two pieces of art, mentioned above? They were sold to him by David Geffen).

In 2017, Geffen announced a $150 million donation to the Los Angeles County Museum of Art – its largest-ever gift – to help build a new building that would be called the “David Geffen Galleries.”

The public health and economic fallout of the COVID-19 crisis is set to magnify in the weeks and months ahead, and the devastation will likely be with us for years to come. As many in corporate America continue to rake in profits off of the crisis from their luxury homes, and as tens of millions of people in the U.S. suffer, the battle over what a post-COVID U.S. will look like, and whether the interests of billionaires will be prioritized over those of working people, will only intensify.

Stephen Schwarzman Biography, House, Yacht, Wife, Career & Net Worth

Share post:

Table of Contents

Blackstone, one of the top investment businesses in the world with $915 billion in assets under management, is led by Stephen Schwarzman chairman, CEO, and co-founder (as of March 31, 2022). Since Blackstone was established in 1985, Mr Schwarzman has participated in all stages of its growth.

In addition to real estate, where it is currently the largest landowner in the world, hedge fund solutions, where it is the largest discretionary hedge fund investor in the world, and credit, where it is a global leader and major lender of credit for small, middle-market businesses, the company has established leading investing businesses across asset classes.

Stephen Schwarzman Bio/Wiki

Sonya Curry Net Worth, Early Life, Career

Schwarzman, the son of Arline and Joseph Schwarzman, was raised in a Jewish household in Huntingdon Valley, Pennsylvania. His father was a Wharton School alumnus and the owner of Schwarzman’s, a defunct dry goods shop in Philadelphia.

When he was 14 years old, Schwarzman started his first company, a lawn-mowing service, where he hired his younger twin brothers, Mark and Warren, to mow while Stephen brought in clients. Schwarzman attended the suburban Philadelphia school system’s Abington Senior High School, where he earned his diploma in 1965.

He studied at Yale University, where he formed the Davenport Ballet Organization and was a member of the senior society Skull & Bones. After receiving his diploma in 1969, he briefly served in the American Army Reserve before enrolling in Harvard Business School, from which he received his degree in 1972.

Erik Prince Net Worth, Age, Family, Wife, Height, Personal Life

Professional Career

Mr Schwarzman is a committed philanthropist who has a history of supporting, among other things, the arts, culture, and education. He committed to giving the vast majority of his wealth to charitable organizations when he signed The Giving Pledge in 2020. Mr Schwarzman has committed himself to find innovative solutions to complex issues in both business and philanthropy.

He gave £150 million to the University of Oxford in June 2019 to assist reimagine humanities education for the twenty-first century. His gift, the largest single donation to Oxford since the renaissance, will build a new Centre for the Humanities that will house all humanities faculties under one roof for the first time ever.

It will also fund the establishment of a new Institute for Ethics in AI and new performing arts and exhibition spaces. He announced a $350 million foundational gift to create the MIT Schwarzman College of Computing in October 2018. This interdisciplinary hub will refocus MIT to address the opportunities and challenges brought on by the rise of artificial intelligence, including crucial ethical and policy considerations to ensure that the technologies are used for the benefit of all.

In addition to giving a founding gift of $40 million to the Inner-City Scholarship Fund, which offers financial aid for tuition to underprivileged children enrolled in Catholic schools in the Archdiocese of New York, Mr Schwarzman donated $150 million to Yale University in 2015 to establish the Schwarzman Center, a first-of-its-kind campus centre housed in Yale’s historic “Commons” building. In order to teach future leaders about China, he established the “Schwarzman Scholars” international scholarship program at Tsinghua University in Beijing in 2013.

The initiative, which cost over $575 million and was funded primarily by foreign donors, is the single largest charitable undertaking in China’s history. It is based on the Rhodes Scholarship. The Board of Trustees for Schwarzman Scholars is co-chaired by Mr Schwarzman. On the board of the New York Public Library, which he serves on, Mr Schwarzman gave a $100 million donation in 2007.

The Business Council, The Business Roundtable, The Council on Foreign Relations, and The International Business Council of the World Economic Forum are all organizations that Mr Schwarzman belongs to. He served as the Partnership for New York City’s previous co-chair and is currently a member of the boards of The Asia Society, New York-Presbyterian Hospital, and The Advisory Board of the School of Economics and Management at Tsinghua University, Beijing.

In addition to serving as Chairman Emeritus of the Board of Directors of the John F. Kennedy Center for the Performing Arts, he is a Trustee of The Frick Collection in New York City. Mr Schwarzman was listed on TIME’s 2007 list of the “100 Most Influential People.” He was placed first on Forbes Magazine’s list of the world’s most powerful people in 2018 and first on the publication’s list of the most influential persons in finance in 2016.

Both the Légion d’Honneur and the Ordre des Arts et des Lettres at the Commandeur level have been given to Mr. Schwarzman by the Republic of France. One of only two Americans, Mr Schwarzman, received both honours for his tremendous services to France.

In addition, for his efforts on behalf of the United States in support of the United States-Mexico-Canada Agreement in 2018, he received the Order of the Aztec Eagle, Mexico’s highest distinction for foreigners. Mr Schwarzman graduated from Yale University with a B.A. and Harvard Business School with an M.B.A. He has held positions on the Harvard Business School Board of Dean’s Advisors and as an adjunct professor at the Yale School of Management.

Stephen Jackson Net Worth, Age, Personal Life, Career, Wife

Political and Economic Views

Republican Schwarzman is. He has been a close friend of former president Donald Trump for a long time and serves as outside counsel. He also chaired the Strategic and Policy Forum for Trump.

In response to criticism for his involvement with the Trump administration, Schwarzman penned a letter to current Schwarzman Scholars, arguing that “having influence and providing sound advice is a good thing, even if it attracts criticism or requires some sacrifice.”

Schwarzman equated a war to Hitler’s invasion of Poland in 1939 when he started in August 2010 that the Obama administration’s proposal to increase the tax rate on carried interest was comparable “There is war. It reminds me of the 1939 invasion of Poland by Hitler.”

Later, Schwarzman expressed regret over the comparison In order to avert a fiscal cliff, Obama summoned Schwarzman in 2012 and asked for his help in negotiating a budget deal with congressional Republicans. Eventually, Schwarzman’s assistance was used to arrange an agreement. By raising taxes, closing tax loopholes, and eliminating deductions, the new tax plan generated an additional $1 trillion in revenue.

Later, Obama prepared a formal statement of support for Schwarzman Scholars, a program he started to help students. He stated in early 2016 that he would choose Donald Trump over Ted Cruz in a two-candidate election, arguing that the country needed a “cohesive, healing presidency, not one that’s lurching either to the right or to the left.”

He had given to Marco Rubio in the past, in 2014. He supported Mitt Romney in 2012 and collected money for him as well. Schwarzman “aided put together” a group of business titans to counsel Trump on the economy and jobs in late 2016. The group, which also includes Bob Iger, the CEO of Walt Disney, Jamie Dimon, the CEO of JPMorgan Chase, and Jack Welch, the former CEO of General Electric, formed Trump’s Strategic and Policy Forum. Schwarzman was appointed chair of the 16-member President’s Strategic and Policy Forum in February.

This group of executives advises the president on “how to create jobs and improve growth for the U.S. economy” and is comprised of “CEOs of America’s biggest corporations, banks, and investment firms.” Following the resignations of five members, President Trump announced the forum’s dissolution on August 16, 2017, via Twitter. “‘Self-Funded’ Trump Now Propped Up By Super PAC Megadonors,” a report by the non-profit consumer advocacy group Public Citizen, was published in December 2018. Schwarzman gave Trump’s re-election campaign $344,000, according to the article.

Schwarzman was named as the White House Strategic and Policy Forum’s chairman by Trump after his election. He gave the 1820 PAC, a group established specifically to aid Senator Susan Collins of Maine in her bid for reelection, $500,000 twice in 2019 and $500,000 again in 2020. The Senate Leadership Fund, a super PAC connected to Mitch McConnell, received a $15 million donation from Schwarzman in 2020.

Carter Sharer Net Worth, Bio, Wife, Twin, New House

Personal Life

In 1971, Schwarzman wed Ellen Philips, a trustee for Mount Sinai Medical Center and Northwestern University. Teddy Schwarzman, a movie producer, and Zibby Owens, a writer and podcaster, were their two offspring.

In 1990, they got a divorce. In 1995, Schwarzman wed Christine Hearst, an attorney for intellectual property who was born and raised on Long Island, New York. She has a child from a previous marriage. John D. Rockefeller Jr. once owned the duplex flat where he resides, which is located at 740 Park Avenue. Saul Steinberg sold the apartment to Schwarzman.

Both his sixty-fifth and seventieth birthday parties cost millions of dollars. The massive water use of rich Palm Beach homeowners amid an unprecedented drought was covered by The Wall Street Journal in 2011. Schwarzman, who used 7,409,688 gallons of water between June 2010 and May 2011, was among the top five users. The typical Palm Beach resident uses 108,000 gallons of water annually.

Stephen Schwarzman Net Worth

Schwarzman’s wealth is obtained from the Blackstone Group, a private equity corporation that, according to the company’s website, had $941 billion in assets under management as of March 31, 2022.

The 2021 annual report states that approximately 19% of the publicly traded corporation is owned by Schwarzman. According to a study of company filings and Bloomberg statistics, he sold Blackstone shares worth approximately $675 million in the company’s June 2007 first public offering and has received more than $5 billion in pay and dividends since 2004.

These revenues, along with other insider transactions, taxes, and market performance, are used to determine the value of his cash investments. According to PJT Partners’ 2022 proxy statement, Schwarzman controls over 5.8 million shares and units that were purchased as part of the company’s spin-off from Blackstone.

In 2016, he gave away his Brixmor Property Group shares, according to information gathered by Bloomberg.

Steve will do it Net Worth, Early Life, Career

How much is the net worth of Stephen Schwarzman ?

$26.7 Billion

Who is Stephen Schwarzman’s wife?

Christine Hearst Schwarzman

What is Stephen Schwarzman’s age?

What is the name of the Stephen Schwarzman firm?

Blackstone Group

10 Best AI Bypassers to Bypass AI Detection (Free & Paid)

Safety measures for hbot at home: everything you should know, icufull form: intensive care unit, nicu, picu, micu., filmy4way movie, explor new bollywood movies., flyfish review – enhancing your corporate payments globally, vijeta pendharkar , her age, husband, career and net worth., related articles.

WoodGram blog provides news on important information and updates from different sectors i.e Technolgy, Business, Sports and much more.

- Privacy Policy

- Terms and Conditions

Latest news

Popular news.

© 2021 Wood Gram

- Starting a Business

- Growing a Business

- Business News

- Science & Technology

- Money & Finance

- Subscribers For Subscribers

- ELN Write for Entrepreneur

- Store Entrepreneur Store

- Spotlight Spotlight

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

These Are the Highest Paid CEOs — And 9 Make More Than $100 Million a Year, According to a New Report Blackstone CEO Stephen Schwarzman took the top spot from Alphabet's Sundar Pichai in total compensation in 2022.

By Entrepreneur Staff • Jul 6, 2023

Key Takeaways

- A CEO pay analysis examined CEO total compensation for 2022.

- Nine CEOs earned more than $100 million.

- Apple's Tim Cook wasn't one of them.

Running a company is tough, but spending the summer sailing on your yacht certainly makes up for it.

A new report by C-Suite Comp, examined by the Wall Street Journal , found that nine CEOs took home $100 million or more in total compensation in 2022. Nine is actually low—there were 20 in 2021, according to the company's analysis.

The top spot went to Blackstone CEO Stephen Schwarzman, whose total compensation reportedly earned $253 million.

No. 2 was Google and Alphabet CEO Sundar Pichai, with a pay package of $226 million.

Related: Google CEO Responds to Accusations That Company is 'Nickel and Diming' Workers: 'We Shouldn't Always Equate Fun With Money'

Six of the top 10 highest-paid chief executives are running companies that aren't in the S&P 500 (the largest publicly-traded companies in the U.S.), per the WSJ .

The CEOs of well-known companies such as Peloton, Pinterest, and Hertz each brought in more than $100 million last year. Michael Rapino, CEO of Live Nation, and Safra Catz, CEO at Oracle, also made the list, bringing in just under $150 million each.

Apple's Tim Cook earned $99 million, which was No. 10 on the list.

Read the full list and analysis, here .

Entrepreneur Staff

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- She Never Wanted to Start a Business , But Chronic Insomnia Was Motivation — Here's How She Achieved 8 Figures in Sales and 8 Hours of Sleep a Night

- Lock There's a Retirement Crisis on the Horizon — See How Your Savings Compare to the Rest of Your Generation's

- Lock Is There a Superior Diet for the Entrepreneur? The 'Father of Biohacking' Shares What He Eats for High Energy, Low Body Fat and Optimal Output

- This Startup Pays Users to Watch Ads While Streaming Their Favorite Shows

- Lock A Side Hustle Consultant Shares the Most Lucrative Gigs Right Now

- He Owns and Operates a Dozen Popular Nightlife Venues in New York — Here's How He Kept All of His Businesses Afloat in a Crisis

Most Popular Red Arrow

After being laid off twice in 2 years, he realized he could 'be brave,' or 'fail to attain my potential.' now his business makes over $1 million a month..

At 41, Josh Grinstead knew he was at a crossroads.

I Was a 25-Year-Old Nurse When I Started a Side Hustle to Combat Anxiety. It Made $1 Million in 7 Months — Then Sold for a Life-Changing Amount.

Sarah Michelle Boes knew there had to be a better way to prepare for her stress-inducing nurse practitioner's exam — so she created it.

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

MacKenzie Scott Donates $640 Million to Non-Profits After Elon Musk's 'Ex-Wife' Comment on X

The winning applicants span 38 states, Washington, D.C., and Puerto Rico.

Want to Attract Success? Don't Do These 9 Things

We are constantly told what to do if we want success — but what about the habits to avoid?

How to Provide More Value to Your Customers And Scale Your Company

Here are three value-add products and services that can help your business scale.

Successfully copied link

- About Us & Contact

- Advertise with Buzz

Miramar sells for $27 million

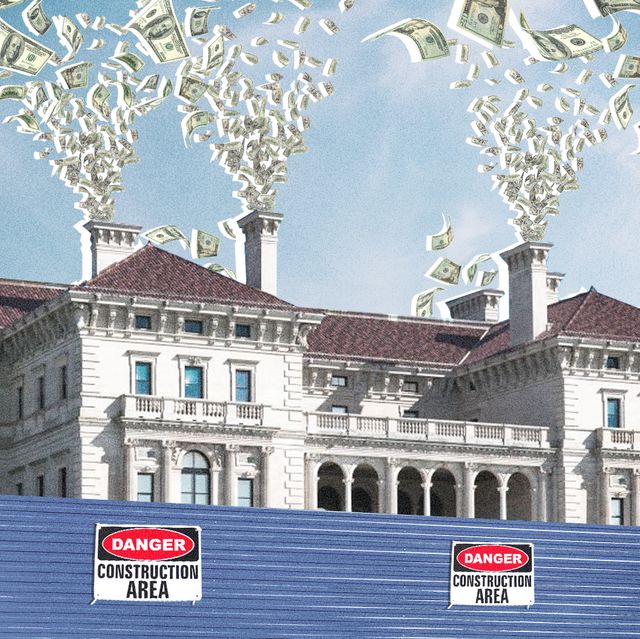

Gustave White Sotheby’s International Realty announced the sale of ‘Miramar’ at 646 Bellevue Avenue in Newport, RI. The seller was represented by David Huberman of Gustave White Sotheby’s International Realty. The buyer, Blackstone Chairman and CEO Stephen Schwarzman, was unrepresented.

Located on Bellevue Avenue, ‘Miramar’ is among Newport’s finest Gilded Age mansions and one of its largest private homes with an oceanfront setting offering panoramic views of the Rhode Island Sound and Atlantic Ocean.

In 1912 George D. Widner of Philadelphia commissioned architect Horace Trumbauer to design a summer cottage for his family. Trumbauer had designed several prominent buildings in Philadelphia as well ‘The Elms’ in Newport, his design for ‘Miramar’ was a neoclassical

French petit palais constructed of limestone inspired by eighteenth- century French architecture. On over 8 acres, the grounds were designed by French landscape architect Jacques Greber, who laid out the grand parterre gardens facing Bellevue Avenue.

In April of 1912, the Wideners were returning from a visit to Paris where, among other things, they were looking for furniture and decorative objects for their Newport house. They were aboard the RMS Titanic.

In the early morning hours of April 15th, 1912, Eleanor Elkins Widener and her maid stepped into one of the lifeboats after the ship struck an iceberg. Her husband, George, and her son, Harry, did not survive. Upon her safe return to America, the widowed Mrs. Widener continued with plans for her Newport house, named ‘Miramar’ (Spanish for “sea-view’) as a memorial to her husband. Eleanor later donated the money to Harvard University to build the Harry Elkins Widener Memorial Library in her son’s memory who was a Harvard alumni and avid book collector.

Listing agent David Huberman of Gustave White Sotheby’s International Realty said “Miramar is a once-in-a- lifetime opportunity to own one of the most spectacular estates in Newport. The design, construction, setting, and historical pedigree of this property are second to none. From private entry through its elaborate gates, to the flow through arched doorways from formal dining spaces through grand ballrooms to its exquisite seaside terrace it offers grandeur, and an opportunity to own a piece of history that cannot be recreated.” Its most recent owners had undertaken a detailed study and conservation of the estate with an international team of preservation consultants and advisors. Exterior stone cleaning, repointing, roof and balustrade work, a new geothermal heating and cooling system, interior paint analysis, tree care, and much more have been implemented, bringing the house and grounds on a course back to the original vision of Mrs. Widener and her design team.

Stephen A. Schwarzman is Chairman, CEO and Co-Founder of Blackstone, one of the world’s leading investment firms with $684 billion Assets Under Management. Schwarzman’s net worth is reportedly $33 Billion.

This historic sale comes on the heels of Clarendon Court selling for $30 Million , making it the highest sale price for a private home ever in Rhode island.

Senator Sheldon Whitehouse Achieves Policy Wins in Latest Appropriations Bill

Like Newport Buzz? We depend on the generosity of readers like you who support us, to help with our mission to keep you informed and entertained with local, independent news and content. We truly appreciate your trust and support!

Share this:

Is New Money Changing High Society's Favorite Summer Destination Forever?

Inside the billionaires' battle for the soul of Newport, Rhode Island.

Every item on this page was chosen by a Town & Country editor. We may earn commission on some of the items you choose to buy.

Ellison has spent more than $100 million to renovate Beechwood and create a museum to house part of his art collection. He has had security guards posted at the construction site 24/7, according to a neighbor. So, with a mix of eager anticipation and worried trepidation, locals wondered if this would be the summer that Ellison would finally put down roots in town and bring his 288-foot yacht, Mushashi , to Newport harbor.

Ellison’s arrival in Newport coincides with two other famous faces buying property in the area: “Judge Judy” Sheindlin and comedian Jay Leno. In 2019, Sheindlin purchased the Bird House for $9 million . The estate was previously owned by Campbell’s Soup heiress Dorrance "Dodo" Hamilton. Leno, meanwhile, paid $13.5 million for Seafair in 2017 . The crescent-shaped, 15,861-square-foot home on Ocean Drive played host to President Barack Obama when he attended a Newport fundraiser in 2014.

And while the so-called nouveau riche have been buying and building estates in Newport since the Gilded Age (memorialized in an upcoming HBO series from Downton Abbey creator Julian Fellowes ), insiders say the current influx of wealth—spurred on by the recent pandemic—has many wondering whether Newport is heading the way of the Hamptons.

“The money has been going out of the traditional families in Newport for a long time,” says photographer Nick Mele, who has been called a modern-day Slim Aarons. “The new generation are not able to sustain the lifestyles that their parents were able to.” He knows from experience. Following the 2018 death of Mele’s grandmother Marion “Oatsie” Charles, the noted Newport and Georgetown society figure, his family decided to sell her former house. Located on six acres, Land’s End had previously been Edith Wharton’s summer home, and it was listed for $11.7 million in 2019. The house sold for $8.6 million in April 2020 . The new buyers were identified in the Wall Street Journal simply as “a family from Connecticut who had previously spent summers in the Newport area.”

“Anytime you get an old community that has had the same families in it for generations, you do get a sense of a sense of encroachment (‘this is our town’), but I think it’s just as much a sadness that the money is not in those families any more than it is that these new people are coming in, because there’s really no choice,” Mele says. “You see fewer and fewer of these iconic properties that we grew up in staying in the families of our friends, but that’s no one’s fault but our own.”

He added that while the properties might not be expensive compared to destinations like the Hamptons, real estate taxes are incredibly high in Newport, and many of the old houses, especially those along the oceanfront, require a significant amount of upkeep.

How Newport Became Newport

David Ray, who owns the legendary Clarke Cooke House, remembers when the U.S. Navy announced in 1973 that it was pulling its Atlantic destroyer fleet out of Newport. “It totally changed the town, because it was a white-hat sailing town,” Ray says.

Ray moved the Clarke Cooke House building to its current location in 1973 and bought Bannister’s Wharf, on which it sits, in 1975. In 1976, tall ships arrived in Narragansett Bay and paraded under the Newport Bridge as part of a July 4 celebration for the Bicentennial . “The town got a tremendous amount of publicity—there were tens of thousands of people walking up and down this wharf,” Ray says. Prince Philip and Queen Elizabeth II visited around that time too.

The following year, Ted Turner won the America’s Cup in Newport Harbor. “That’s what really started putting Newport on the map—the tall ships and the America’s Cup, big events year after year,” Ray says. “Up until that point in time, nobody came here. There was no tourist business—zero.”

Ray says that the number-one ingredient that separates Newport from any other resort town in America is its deep-water harbor. It was a deciding factor in the New York Yacht Club’s purchase of Harbour Court as an outpost for the club in the late 1980s. A sailor and former owner of the Newport Shipyard, Charlie Dana was involved in the yacht club's purchase of the former Brown (of Brown University) family home. Dana and Ray, along with a cadre of other NYYC members, joined an initiative spurred on by Charles A. Robertson and Commodore Robert G. Stone, Jr. to purchase Harbour Court from the Brown family in 1987. The striking house on a hill overlooking the harbor, which was completed in 1906, was sold to the club the following year for $4.5 million .

“Newport was sort of dying on the vine,” Dana says, “and the summer of ’77 was a big deal because Ted Turner brought a lot of attention to the America’s Cup and to Newport.”

“Like many places, it was centered around club life, and people wouldn’t buy house unless they could get into Bailey’s Beach,” he says, referring to the exclusive beach club officially named the Spouting Rock Beach Association. Having the New York Yacht Club open a clubhouse in town “did huge things for Newport because all of a sudden the boat people came.”

Wharfs like Bowen’s Wharf and Bannister’s Wharf, where the culinary institution The Clarke Cooke House is located, began to fill up, Dana says, and life ceased to revolve exclusively around Bailey’s Beach.

Doris Duke’s actions after the famous automobile accident in which she was involved are another reason Newport gained national prominence, especially for its architecture. In the days following the 1966 car accident that killed her interior designer friend Eduardo Tirella under suspicious circumstances ( Duke was at the wheel of the car that fatally crushed him against the gate of her estate, Rough Point, after he got out to open it ), the tobacco heiress reportedly donated $25,000 to restore the Cliff Walk and $10,000 to Newport Hospital. A few months later, she established the Newport Restoration Foundation , which has renovated more than 80 Colonial-era buildings in Newport and neighboring Middletown.

“Until her death in 1993, saving Newport’s colonial architectural heritage would remain a singular philanthropic focus” for Duke, her biography on the Restoration Foundation’s website states. There is no mention of the accident—or any deal Duke may have struck with local authorities that resulted in the police chief at the time calling it an “unfortunate accident” and declaring, “There is no cause to prefer charges against Miss Duke and as far as this department is concerned this case is closed.”

That changed in early August, however, when the only known eyewitness came forward and spoke with the author of a recently released book about Tirella’s death, Homicide at Rough Point . Bob Walker was a 13-year-old paperboy intending to deliver a newspaper when he biked up to 680 Bellevue Avenue on the afternoon on October 7, 1966.

“I initially heard the argument and screaming of two people,” Walker told the book’s author, Peter Lance, according to Vanity Fair . “The arguing stopped for a couple of seconds, and the next thing I heard was the roar of a motor, the crash, and the screaming of a man.”

Walker, who is now 68 and a former Marine, told Lance that he approached the scene and saw a woman get out of her car. “She was a rather tall woman—regal,” Walker says. As Walker approached from behind her, he says, “She spun around and looked at me. I said, ‘Can I help you, ma’am?’ And she said,”—screaming and pointing her finger—“‘You better get the hell out of here!’”

Walker’s statements prompted the Newport Police Department to reopen the case. “I can confirm that I’ve been assigned to follow up with this case due to new information provided by Robert Walker,” Newport Police Det. Jacque Wuest told the Newport Daily News on August 5. The “case is now open for further review due to new facts coming forward,” Wuest said. “It is an active investigation.”

Celebrities in Newport

“I ended up in Newport because I was driving down Ocean Avenue with my wife, and she said, ‘Look at that house” as we passed Seafair,” Leno says in a telephone interview. “I said, ‘Let’s go back.’ Just as we drove by again, the gate opened and the caretaker came out. I asked if the house was for sale, and he said technically it was for sale but wasn’t listed. He gave us a tour and got the owner on the phone, and he agreed to sell it to us furnished.”

Leno, who grew up in Andover, Massachusetts and first visited the area when he went to the Newport Jazz Festival as a high schooler to watch Slip Wilson perform, now uses the house to host family gatherings. “When you live in California and all the relatives want to come visit, it’s a nightmare because I spend weeks clearing the house,” Leno said. “In Newport, it’s all taken care of—I don’t even have to vacuum—and everybody has their own room.”

“I got a mansion for the price of a condo on Wilshire Boulevard,” Leno says of his 2017 purchase. Since then, prices have increased dramatically, and Leno expects Seafair is worth twice as much as he paid for it, if not more.

A more well-heeled crowd isn’t so bad for the city, he said.

“I eat at a place on Thames Street, the Handy Lunch, and they’re thrilled because bigger tippers come in and they spend more money,” Leno says. The downtown area “used to be a mix of knick-knack shops selling ash trays made out of lobsters, and now you’ve got five-star restaurants going in there and they’re quite good.”

While Judy Sheindlin, through a representative, declined a request to be interviewed, a source familiar with her Newport life said she likes to keep a low profile when she is there.

Leno and Sheindlin are not the first celebrities to settle in Newport. Nicholas Cage owned one of the largest houses in the Newport area, Grey Craig—in Middleton, where St. George’s School is located—from 2007 through 2011. He paid $15.7 million for the 24,000-square-foot house on 27 acres when he purchased it from Charlie Dana. Cage listed it for $15.9 million in 2008; it sold for just $6.5 million in 2011 , a loss of $9.2 million.

But the first celebrity to call Newport home arrived nearly a century ago. In the 1940s, Broadway star Gertrude Nielsen became the owner of Rosecliff after her mother purchased the home at auction for $17,000 . Life magazine featured her in an article titled “ Life Visits a Palace at Newport.”

Ruth Buchanan, the late Dow Chemical heiress, and her husband Wiley T. Buchanan Jr. bought Beaulieu, next to Marble House on Bellevue Avenue , for $100,000 in 1961. One weekend, the Buchanans invited Elizabeth Taylor as a houseguest. “My grandmother called the hostess of the dinner she was invited to that Friday night, Anita Young, and asked if she could bring her houseguest to dinner,” the Buchanans’ grandson, entrepreneur and former U.S. Ambassador to Austria Trevor Traina, says.

“Mrs. Young said, ‘Absolutely not, we would never have an actor in the house,’ so the butler had to serve dinner to Elizabeth Taylor alone because my grandmother could not unaccept an invitation, which would be rude, nor could she bring an actress, which would be rude.” Traina also noted that Taylor had her bathtub at Beaulieu filled with ice and kept it stocked with beer all weekend, “which I think reaffirmed some of the doubts in the community about inviting her for the weekend.”

“What has changed today is that most of the people in Newport would kill to get an invitation to an actor’s house today rather than refuse to entertain them in yesteryear,” Traina says. “When you walk around Bailey’s Beach, much of the talk is about who bought which house, including Larry Ellison and Jay Leno’s recent purchases, of course.”

Will Newport Become the Hamptons?

“I think Newport will stay uniquely New England, because the people here seem to like the not-so-flashy, not-so-Hollywood lifestyle,” Leno said. “I can walk around as shabbily dressed as I usually am, and no one thinks twice about it.”

Leno’s friend Donald Osborne, who serves as Director and CEO of the Audrain Auto Museum (for which Leno is a major fundraiser) and has made a number of appearances on the TV show Jay Leno’s Garage , has an idea about why the area will remain low-key. “On Aquidneck Island, in addition to Newport, you also have Middletown and Portsmouth, which are very nice middle-class communities that offer the opportunity for people to live in a place very adjacent to the best real estate in the state. Anything affordable in the Hamptons is at least seven towns away.”

In addition, Osborne says, “Newport will never be like the Hamptons because it is a uniquely historic city. Newport is a city founded in the 17th century with great history, so it has a totally different feeling than resorts that can’t match the history.” It also has a strong social fabric, with younger generations returning to the same places their parents frequented when they were children to take part in traditions like the sandcastle contest at Bailey’s Beach and ending dinner at the Clarke Cooke House with a Snowball in Hell .

“The generations all interface at parties,” says Bettie Bearden Pardee , whose books Private Newport at Home and in the Garden and Living Newport: Houses, People, Style chronicle how people live and entertain in the seaside town. “You don’t have only old people and only young people. I had a conversation at a luncheon the other day with someone who said he’s never seen that in any other summer community—this mix of generations.”

Piper Quinn, who owns the buzzy Buccan and Grato restaurants in Palm Beach and spends summers in Newport, says that while the general vibe hasn’t changed much in the past four decades, he has noticed high-profile yacht owners coming to town more recently. “That is something that was not here 20 years ago,” he says.

“The timelessness of Newport makes it different from the Hamptons and Nantucket. The Hamptons could use some of Newport. Nantucket could use some of Newport,” he says.

It’s also harder to get to from New York on public transportation than the Hamptons, as Ray explains: “Psychologically, the Hamptons are a lot closer.” Newport is not serviced by luxury buses like the Hampton Jitney and the Hampton Luxury Liner, and those who take Amtrak from Penn Station have to find transportation for the final leg of the journey Kingston to Newport—about a 25-minute drive.

Ruthie Sommers, an interior designer who lives in Newport during the summer and is currently working on a book about the area with Mele, says the values that Newporters have will prevent it from going the way of the Hamptons. “I believe people who are drawn to Newport are drawn to the nature of the rocky coastline or to the idea of community, Sommers said. “Shared values allow all ships to rise with the tide. Our values are human connection, modesty in terms of discretion, love of entertaining, philanthropy, and nature. If people choose Newport, I feel they are choosing that.”

As Traina put it, “Newport has always been a crucible where new fortunes go to get established, where the new money goes to become old.”

The Exploding Real Estate Market

“It’s billionaires pushing out millionaires,” Leno says of the current market for Newport real estate. “When I bought my house, I think it was the most expensive house in Rhode Island. Now I’m not even in the top 50! People are paying $25 million, $37 million.”

Realtor Kara Malkovich of Gustave White Sotheby's International Realty, who grew up in Newport, says that while the city has been known as the first resort and a sailing gem for decades, “we’ve always been able to scoot under the radar.” No longer is that the case, she says. “I really feel like Newport has totally been found out.”

She and others attribute much of the new attention paid to Newport to the pandemic. “Since Covid,” Malkovich says, “people are putting a lot more thought and emphasis on the quality of their lives and how they want that to look moving forward. I’ve seen a huge influx of buyers relocating here from metropolitan cities like New York and Boston, and from Connecticut and California.” Many of the buyers are planning to live there year-round, Malkovich added.

She said she has never seen a real estate market like the one Newport has experienced in the past year. “It’s unprecedented. People are coming here in droves, and relatively speaking you can still get a great deal here for a fraction of what you would pay in the Hamptons, Nantucket, or Martha’s Vineyard.”

There is, however, limited inventory and high demand from buyers moving to Newport. That, coupled with low interest rates, has led to some of the highest prices in the area in years.

The average list price of a single-family home in Newport, for example, has risen steadily over the past few years, from $967,486 in 2016 to $1,386,150 in 2021. In June, Normandie, an estate on nearly four and a half acres along the coastline, hit the market for $15 million and is currently in contract.

Another waterfront estate, Honeysuckle Lodge, was listed for $10.9 million and had multiple offers before going into contract earlier this year. A Bellevue Avenue spread called Ocean View, which had been listed at $18.85 million, went into contract in August, and an Ocean Avenue property selling for $17 million went into contract on August 19.

“Our high-end properties typically take longer to sell, but in the last six months things have changed drastically,” Malkovich says. “Properties of all price points are being snapped up with multiple offers to boot. It really feels like a feeding frenzy with homes selling well above their asking prices.”

Another issue affecting the market is that many of the so-called legacy homes that have been owned by the same families for decades are not passing on to the next generation. “The families that have owned them are getting older, and they don’t have the time or the wherewithal to maintain them,” Malkovich says.

“That’s why we’re seeing people with the financial means to do what is necessary to keep these homes alive purchase them. They have the funds to restore these houses and a true desire to continue the upkeep and preservation of these landmark legacy estates, which is a beautiful thing,” she said.

One fear among the old guard, however, is that wealthy new owners will overdo the restorations, Dana said. “Oatsie Charles had a great expression, which you can quote me on: ‘Blessed be the poor because they cannot over-restore.’ You worry about too many chandeliers going up where there were none, and there is a little bit of that happening,” he says.

.css-4rnr1w:before{margin:0 auto 1.875rem;width:60%;height:0.125rem;content:'';display:block;background-color:#9a0500;color:#fff;} .css-gcw71x{color:#030929;font-family:NewParis,NewParis-fallback,NewParis-roboto,NewParis-local,Georgia,Times,serif;font-size:1.625rem;line-height:1.2;margin:0rem;}@media(max-width: 64rem){.css-gcw71x{font-size:2.25rem;line-height:1.1;}}@media(min-width: 48rem){.css-gcw71x{font-size:2.625rem;line-height:1.1;}}@media(min-width: 64rem){.css-gcw71x{font-size:2.8125rem;line-height:1.1;}}.css-gcw71x b,.css-gcw71x strong{font-family:inherit;font-weight:bold;}.css-gcw71x em,.css-gcw71x i{font-style:italic;font-family:inherit;} "Blessed be the poor because they cannot over-restore."

Esmond Harmsworth , president of the literary agency Aevitas Creative Management, started spending summers in Newport in the early 1980s. “It’s always been this mixture of the more summer Social Register people and other groups, and there’s always been turnover and speculation about new people coming,” he says. “The great thing about Newport, though, is that its character has not changed very much at all in my lifetime. There is a wonderful joie de vivre and a focus on entertaining and parties in the summer, but there is also this community of historians and experts.”

As an Englishman, Harmsworth says Newport’s eccentricities and eccentric residents appeal to him. “Newport is far too eccentric and quirky to turn into Southampton,” he says. “I remember when I was a teenager gate-crashing the most fabulous and frivolous parties, and I would vote for more of that, so I hope some of these people [moving to Newport] will do more of that.”

Mansions Still in Private Hands

While the Preservation Society of Newport County now owns and maintains 11 historic properties—including The Breakers , the 70-room mansion Cornelius Vanderbilt II built in 1893—a few oceanfront Newport estates remain in private hands.

Beaulieu, for example, was completed in 1859 and designed to resemble a French château and has been in the same family for decades. Following her mother Ruth Buchanan’s death, Dede Wilsey purchased the house in March 2020.

Wilsey has been visiting Newport with her family since her father, Wiley T. Buchanan Jr., bought Beaulieu. John Jacob Astor III, William Waldorf Astor, and Cornelius “Neily” Vanderbilt III had lived in the house before Buchanan, who served as the Chief of Protocol of the United States and the U.S. Ambassador to Luxembourg and Austria, bought it. “My father didn't tell my mother when he purchased the house. We were driving to Newport and stopped at Howard Johnson's,” Wilsey told Town & Country in 2016 . “Daddy looked at me and said, ‘Don't say anything, but let me show you what I just bought.’ It was a flier for Beaulieu, and it looked like a wreck. My parents were the only young couple in Newport, except for the Drexels. They started bringing ambassadors from Washington and prominent people, and all of a sudden the town really had a life.”

Wilsey says that the new wealth coming to Newport is beneficial for the city. “New blood is good for a place, as long as they don’t want to tear down the traditions.”

She added that Larry Ellison’s real-estate purchasing prowess included some strategic moves.

“His representatives were approaching neighbors to buy their property—they weren’t pushy, they weren’t arrogant, and nobody has anything but nice things to say about his organization,” Wilsey says. “He bought a friend of mine’s house two years ago; his people had made offers to my friend and he turned them down, then after the sale happened, I asked him and he said, ‘he made me an offer I couldn’t resist.’”

Wilsey says it is interesting to the Newport establishment that people of Ellison’s magnitude are interested in buying property in Newport. “He could have gone over to Southampton, and so could Judge Judy or Jay Leno. They could have been celebrities there, where people care.”

She added that the famous figures in town have not tried to join the established social clubs. “I haven’t heard a whisper of any of the [celebrities] wanting to join any of the clubs—Bailey’s, Clambake, the Reading Room, or even the Golf Club,” Wilsey says.

Other “new and aggressive” buyers have tried to join the club, but have not been successful, Wilsey says. “They will be fine doing what they are doing but I don’t think they’re going to be adopted by the old guard,” she said. Same with those who try to build houses that do not fit into the architectural landscape, as the New York Times examined in 2016.

“New blood is good for a place, as long as they don’t want to tear down the traditions.”

“Life goes on generation after generation, even though there are divorces and scandals,” Wilsey says. “That’s been going on forever, and everybody just looks the other way or marries one of your friends.”

And in spite of the new arrivals, aspects of the destination have not changed at all. “Newport is predictable,” Wilsey says. “We all know the history, we know who lived there. All those things are kind of written in the sand. There’s not a lot of surprise about Newport. You can sail, you can play golf, you can play croquet, you can play tennis.”

Other Gilded Age mansions remain in private hands. Miramar , for example, was purchased for $17.15 million in 2006 and subsequently restored by former Goldman Sachs banker David B. Ford, who died in September 2020 . The house is rumored to be changing hands soon. According to multiple sources familiar with the transaction, Blackstone Chairman and CEO Stephen Schwarzman and his wife, Christine, are in negotiations to purchase the house. A spokesman for Schwarzman did not return requests for comment. Ford’s son, David B. Ford, Jr., also did not return an email requesting comment. The most recent sale in public records is the 2006 purchase that Ford made through an LLC for $17.15 million . At the time, the price was the highest amount paid for a private residence in Rhode Island . [ Ed Note: Miramar reportedly sold for $27 million on September 30, 2021 . A buyer was not publicly identified at the time. ]

Alex and Ani founder and onetime billionaire Carolyn Rafaelian purchased Belcourt, a 60-room mansion built in 1894, for $3.6 million in 2012 . (Historically, the market for such large houses has not been strong, resulting in the Preservation Society acquiring many of them and others going for a song to wealthy buyers like Rafaelian and Ford.)

As for Ellison, Wilsey and others say it is peculiar that the billionaire has not moved into any of his Newport properties. “To spend that kind of money and not have a presence in Newport, why not do New York or San Francisco?” She added that last summer Ellison did no work on Beechwood, which Wilsey says, “just sat there with guards.”

“In the beginning Ellison was very representative of what I’m seeing as the mindset of the people coming to Newport right now: they love it, they’ve got money, and once they move to Newport they find this inner preservationist in them and put in a lot of money and do a beautiful job restoring old homes,” Pardee says. “But I’m not certain he’s ever been seen around with regard to the house. It's been almost 10 years now and it’s not very pretty to look at when you drive by. There are huge boulders on the front lawn.” The boulders that have been added to the landscaping plan in recent months are among the only indications of progress on the renovation.

Wilsey says, “People are just wondering, what is he going to do?”

Sam Dangremond is a Contributing Digital Editor at Town & Country, where he covers men's style, cocktails, travel, and the social scene.

@media(min-width: 40.625rem){.css-1jdielu:before{margin:0.625rem 0.625rem 0;width:3.5rem;-webkit-filter:invert(17%) sepia(72%) saturate(710%) hue-rotate(181deg) brightness(97%) contrast(97%);filter:invert(17%) sepia(72%) saturate(710%) hue-rotate(181deg) brightness(97%) contrast(97%);height:1.5rem;content:'';display:inline-block;-webkit-transform:scale(-1, 1);-moz-transform:scale(-1, 1);-ms-transform:scale(-1, 1);transform:scale(-1, 1);background-repeat:no-repeat;}.loaded .css-1jdielu:before{background-image:url(/_assets/design-tokens/townandcountrymag/static/images/diamond-header-design-element.80fb60e.svg);}}@media(min-width: 64rem){.css-1jdielu:before{margin:0 0.625rem 0.25rem;}} Where to Go Next @media(min-width: 40.625rem){.css-128xfoy:before{margin:0.625rem 0.625rem 0;width:3.5rem;-webkit-filter:invert(17%) sepia(72%) saturate(710%) hue-rotate(181deg) brightness(97%) contrast(97%);filter:invert(17%) sepia(72%) saturate(710%) hue-rotate(181deg) brightness(97%) contrast(97%);height:1.5rem;content:'';display:inline-block;background-repeat:no-repeat;}.loaded .css-128xfoy:before{background-image:url(/_assets/design-tokens/townandcountrymag/static/images/diamond-header-design-element.80fb60e.svg);}}@media(min-width: 64rem){.css-128xfoy:before{margin:0 0.625rem 0.25rem;}}

The Best Room At... Wedgewood Hotel & Spa

11 Romantic Hotels in (or Near) New York City

Romantic Hotel Stays for Valentine's Day Weekend

A Snob's Guide to Palm Beach

Do We Run on Dunking?

Where Will 'The White Lotus' Season 3 Film?

Winter Vacation Ideas to Start Planning Now

A Snob's Guide to the White Glove Cruise

A Snob's Guide to Mediterranean Cruises

A Snob's Guide to Cruising the Islands

A Snob's Guide to the River Cruise

It’s a guesthouse! Mansion OK’d next to Stephen Schwarzman’s home in Palm Beach

Ceo of blackstone group and wife christine plan to build the house with elaborate lakeside gardens at 1800 s. ocean blvd., next door to their ocean-to-lake home..

Private-equity billionaire Stephen A. Schwarzman, CEO of The Blackstone Group, has won Town Hall approval to build a two-story mansion — to be used as a guesthouse — on an ocean-to-lake property next door to the landmarked house he shares with wife Christine on Billionaires Row in Palm Beach .

The three-bedroom mansion at 1800 S. Ocean Blvd. would be used by the Schwarzman's children and grandchildren, the Architectural Commission was told before it approved the design Wednesday. The lot is immediately south of the Schwarzmans’ home.

In addition to serving as a guesthouse, the mansion was designed to provide a critical “wind block” to prevent ocean breezes from harming the elaborate gardens planned for the lake side of the property, architect Gerard Beekman told the commission during the two meetings it took to get the design approved.

The house — with landscaping by Fernando Wong of Fernando Wong Outdoor Living Design — would be built on a vacant lot of about 3 acres at 1800 S. Ocean Blvd.

Donation news: Schwarzmans step up, again, to feed hungry children and families

The property was for years home to a mansion, guesthouse and elaborate gardens owned by the late attorney Robert “Bob” M. Montgomery Jr. and his late widow, Mary Montgomery, who died Feb. 9 at 91 .

The Montgomery house was sold for a recorded $37.375 million in April 2018 to an unidentified developer. The Schwarzmans later acquired it, although their identity was cloaked in public records because of the way the sale was structured, courthouse records show.

The sale to the developer had “triggered them to save this land and begin thinking about a special garden,” said Beekman, a principal at Madison Worth Architecture in Palm Beach.

The architect spoke during a meeting held live in Town Hall without the virtual component that had been the norm for the commission during the coronavirus pandemic. It was a farewell meeting, of sorts, for board Chairman Michael B. Small and Commissioner Alexander Ives, who are stepping down because of term limits. Small served nine years on the commission, and Ives, 11.

More architectural news: 'It’s too much': Palm Beach house with nautical details hits choppy water in design review

The house Beekman presented to commissioners was significantly pared down from the building he first showed them in January. At that meeting, commissioners weren’t told that the Schwarzmans were behind the project or that the mansion — with 20,000 square feet of interior space — would be used as their guesthouse.

The design commissioners first reviewed stretched nearly the width of the lot, the better to block salty ocean winds from reaching the terraced garden on the west side of the property. The architecture was a mix of “traditional Anglo-Caribbean and Georgian styles,” according to the application for the project.

The layout of the house comprised a central portion with outlying structures to the north and south, connected to the main wing by open-air passages with gazebos.

More architectural news: Palm Beach panel nixes new house designed for lot next to home of Roger Ailes’ widow

At the end of the January meeting, commissioners not only wanted the house reduced in size but also asked for refinements to the architecture, particularly to a parapet on the central part of the house’s lakeside façade.

Board members also said the house needed more screening from the street.

“We took your comments seriously and as a result, our work is more successful,” Beekman told the board Wednesday. “The architecture is elegant, sober and classical.”

He later added: “The architecture and the landscape are choreographed in unison.”

The redesign kept the house’s essential layout intact. But the width of the building was significantly reduced, as was its height. Parts of the house also were pushed farther back from the street.

Wong added two garden areas at the front of the property and designed much lusher landscaping to help screen the façade.

Most of the landscape by the lake remained unchanged from January. The plans show that terraces would follow the downward slope of the land from east to west.

The gardens would include two “follies,” or decorative structures, on opposite sides of the swimming pool. One would be a small luncheon pavilion with a six-sided roof. The other would be an open-trellis structure called an orchidarium. In the southwest corner of the lot would be an air-conditioned “lounging folly” with a sitting room and wet bar.

Commissioner Betsy Shiverick was pleased with the changes.

“Thank you for paying such close attention our comments last month and bringing us a new and impressive project,” she said.

Shiverick added that she would like the decorative caps on the two gazebos to be taller. Beekman had lowered their height in his redesign.

Alternate Commissioner Katherine Catlin said the project had gone “from beautiful to extraordinary.” She called the architecture “elegant and romantic” and described the landscaping “like the cherry on top.”

Commissioner Maisie Grace said she would like to see a lower privacy hedge along the front of the house to better allow passersby “to see what you’ve created.”

Other board members were lavish in their praise, although Commissioner John David Corey said the roof was too steeply pitched.

The motion leading to the 6-1 vote approving the project called for raising the heights of the pagoda caps and softening the slope of the roof. Commissioner Jeff Smith, who cast the dissenting vote, said he was voting no only because he thought the roof was fine as it had been presented.

Before the vote, Small told his colleagues he was a fan of the project: “I would love to be able to say I voted for this at my last meeting — and it was approved.”

The Schwarzmans’ house next door at 1768 S. Ocean Blvd. is a traditional-style home known as “Four Winds,” which originally was designed in 1937 by the firm of noted architect Maurice Fatio.

The Schwarzmans stirred controversy in 2004 after they got the Landmarks Preservation Commission’s approval to renovate and expand the house with a second-floor addition. But town officials were shocked when the house was demolished after an inspection showed the original structure could not support the addition. The Schwarzmans ultimately rebuilt the house, replicating the original architecture along with their addition, thus allowing the house to retain its landmark designation.

Darrell Hofheinz is a USA TODAY Network of Florida journalist who writes about Palm Beach real estate in his weekly “Beyond the Hedges” column. He welcomes tips about real estate news on the island. Email [email protected], call (561) 820-3831 or tweet @PBDN_Hofheinz. Help support our journalism. Subscribe today .