The global authority in superyachting

- NEWSLETTERS

- Yachts Home

- The Superyacht Directory

- Yacht Reports

- Brokerage News

- The largest yachts in the world

- The Register

- Yacht Advice

- Yacht Design

- 12m to 24m yachts

- Monaco Yacht Show

- Builder Directory

- Designer Directory

- Interior Design Directory

- Naval Architect Directory

- Yachts for sale home

- Motor yachts

- Sailing yachts

- Explorer yachts

- Classic yachts

- Sale Broker Directory

- Charter Home

- Yachts for Charter

- Charter Destinations

- Charter Broker Directory

- Destinations Home

- Mediterranean

- South Pacific

- Rest of the World

- Boat Life Home

- Owners' Experiences

- Interiors Suppliers

- Owners' Club

- Captains' Club

- BOAT Showcase

- Boat Presents

- Events Home

- World Superyacht Awards

- Superyacht Design Festival

- Design and Innovation Awards

- Young Designer of the Year Award

- Artistry and Craft Awards

- Explorer Yachts Summit

- Ocean Talks

- The Ocean Awards

- BOAT Connect

- Between the bays

- Golf Invitational

- Boat Pro Home

- Pricing Plan

- Superyacht Insight

- Product Features

- Premium Content

- Testimonials

- Global Order Book

- Tenders & Equipment

How Jordan Belfort's 37m superyacht Nadine sank off the coast of Sardinia

Related articles.

Coco Chanel was famously outspoken on many things, but yachting, in particular, attracted her ire. “As soon as you set foot on a yacht you belong to some man, not to yourself, and you die of boredom,” she was once quoted as saying.

Her solution was to buy her own yacht. A 37m with a steel hull, built by the Dutch yard Witsen & Vis of Alkmaar. The yacht passed through many hands, finally ending up belonging to the Wolf of Wall Street, Jordan Belfort, on whose watch she foundered and sank in 1996.

The yacht was originally built for a Frenchman under the name Mathilde , but he backed out and she caught Chanel’s eye instead. With a narrow beam, a high bow and the long, low superstructure typical of Dutch yachts of her era, she was certainly a beautiful boat. But she was also well equipped, with five staterooms in dark teak panelling, magnificent dining facilities, room for big tenders and, later, a helipad. A frequent sight along the Florida coast, she caught the eye of a young skipper called Mark Elliott.

“In those days, she was the biggest yacht on the East Coast,” he remembers. “Nobody had ever seen anything like it. I needed a wrench once and went up to the boat - Captain Norm Dahl was really friendly.” He didn’t know it then, but Elliott was destined to become the skipper of the boat himself and was at the helm when the storm of the century took her to the bottom off Sardinia.

Coco Chanel died in 1971 and sometime thereafter the yacht was renamed Jan Pamela under the new ownership of Melvin Lane Powers. He was a flamboyant Houston real estate developer, fond of crocodile skin cowboy boots and acquitted of murder in a trial that gripped the nation.

Powers sent Jan Pamela to Merrill Stevens yard in Miami, where a mammoth seven-metre section was added amidships. “We made templates for the boat where we were going to cut her in half, then she went out for another charter season,” remembers Whit Kirtland, son of the yard owner. “When the boat came back in, we cut it just forward of the engine room, rolled the two sections apart and welded it in.”

He remembers how the sun’s heat made the bare and painted metal expand at different rates. “You had to weld during certain time periods – early in the morning or late at night,” says Kirtland.

The result of the extension was a huge new seven-metre full-beam master stateroom, an extra salon and one further cabin – pushing the charter capacity to seven staterooms. During this refit, the boat’s colour was also changed from white to taupe. “No one had really done it before and it was gorgeous,” says Elliott. By 1983, Powers was bankrupt and the yacht was sold on again. She next shows up named Edgewater .

Elliott’s chance came in 1989. He was working for the established yacht owner Bernie Little, who ran a hugely profitable distribution business for Bud brewer Anheuser-Busch. “Bernie Little had always wanted to own the boat,” Elliott says. “He loved it. He bought it sight unseen – and I started a huge restoration programme, including another extension to put three metres in the cockpit.”

It was a massive task, undertaken at Miami Ship. “We pulled out all the windows, re-chromed everything, repainted – brought it back to life,” says Elliott. They also cut out old twin diesels from GM and replaced them with bigger CAT engines, doubling her horsepower to 800. “Repowered, she could cruise at up to 20 knots. She was long and skinny, like a destroyer.”

A smart hydraulic feature was also brought to life for the first time. Under two of the sofas in the main stateroom were hidden 3.6m x 1.2m glass panels giving a view of the sea under the boat. At the push of a button, the sofas lifted up and mirrors above allowed you to gaze at the seabed – from the actual bed.

Now called Big Eagle , like all of Little’s boats, she was a charter hit and her top client was a certain New York financier named Jordan Belfort. He fell in love with her and begged Little to sell to him. But he needed to secure financing, and in 1995, Little agreed to hold a note on the boat for a year if Mark Elliott stayed on as skipper.

With the boat rechristened Nadine after his wife, Belfort set about another round of refit work, restyling the interior with vintage deco and lots of mirrors, extending the upper deck this time, and fitting a crane capable of raising and stowing the Turbine Seawind seaplane.

Nadine also carried a helicopter, a 10m Intrepid tender, two 6m dinghies on the bow, four motorbikes, six jetskis, state-of-the-art dive gear. “You pretty much needed an air traffic controller when all these things were in the water,” says Elliott.

Belfort’s partying was legendary and Elliott clearly saw eye-watering things on board, but as far as he was concerned, he was there to safeguard the boat. “When Jordan Belfort became the owner, he could do whatever he wanted. I was there to protect the note,” says Elliott. “He is a brilliant mind and a lovely person. It was just when he was in his party mode, he was out of control.”

Nadine and her huge cohort of toys and vehicles plied all the usual yachting haunts on both sides of the Atlantic. But Belfort’s love story was to be short-lived. Disaster struck with the boss and guests on board during an 85-mile crossing between Civitavecchia in Italy and Calle de Volpe on Sardinia.

What was forecast to be a 20-knot blow and moderate seas degenerated into a violent 70-knot storm with crests towering above 10.6m, according to Elliott. Wave after wave pounded the superstructure, stoving in hatches and windows so that water poured below and made the boat sluggish. By a miracle the engine room remained dry and they could maintain steerage way, motoring slowly through the black of the night as rescue attempt after rescue attempt was called off.

Nadine eventually sank at dawn in over 1000m of water just 20 miles from the coast of Sardinia. Everyone had been taken off by helicopter, and there was no loss of life. Captain Mark Elliott was roundly congratulated for his handling of the incident. “The insurance paid immediately because it was the storm of the century,” he says. “I took the whole crew but one with me to [Little’s next boat] Star Ship . That was my way to come back.”

More stories

Most popular, from our partners, sponsored listings.

Join our Newsletter

Subscribe to B.H. Magazine

Share the article.

Royal Huisman’s Project 406 Is The World’s Largest Purpose-Built Fishing Boat

Ferrari Is Officially Entering The Yacht Game

Steven Spielberg Takes Delivery On His Cinematic $250 Million Superyacht

The 33-Metre Sanlorenzo SP110 ‘Steel It’ Motor Yacht Is A Jet-Powered Masterpiece

Conor McGregor Enjoyed The Monaco Grand Prix From His $5.5 Million Lamborghini Yacht

Related articles.

BMW Debuts ‘The Icon’ Boat With Soundscape Designed By Hans Zimmer

Step Inside The 75m Kenshō: 2023’s Motor Yacht Of The Year

Russian Superyacht’s Crew Spends Past Year Playing ‘Call Of Duty’ & Chilling By Pool

Superyacht Private Security Engaged In A Gun Battle With Pirates Off The Coast Of Yemen

The Feadship Project 710 Is 84m Of Sustainable Superyacht

- TV & Film

- Say Maaate to a Mate

- First Impressions - The Game

- Daily Ladness

- Citizen Reef

To make sure you never miss out on your favourite NEW stories , we're happy to send you some reminders

Click ' OK ' then ' Allow ' to enable notifications

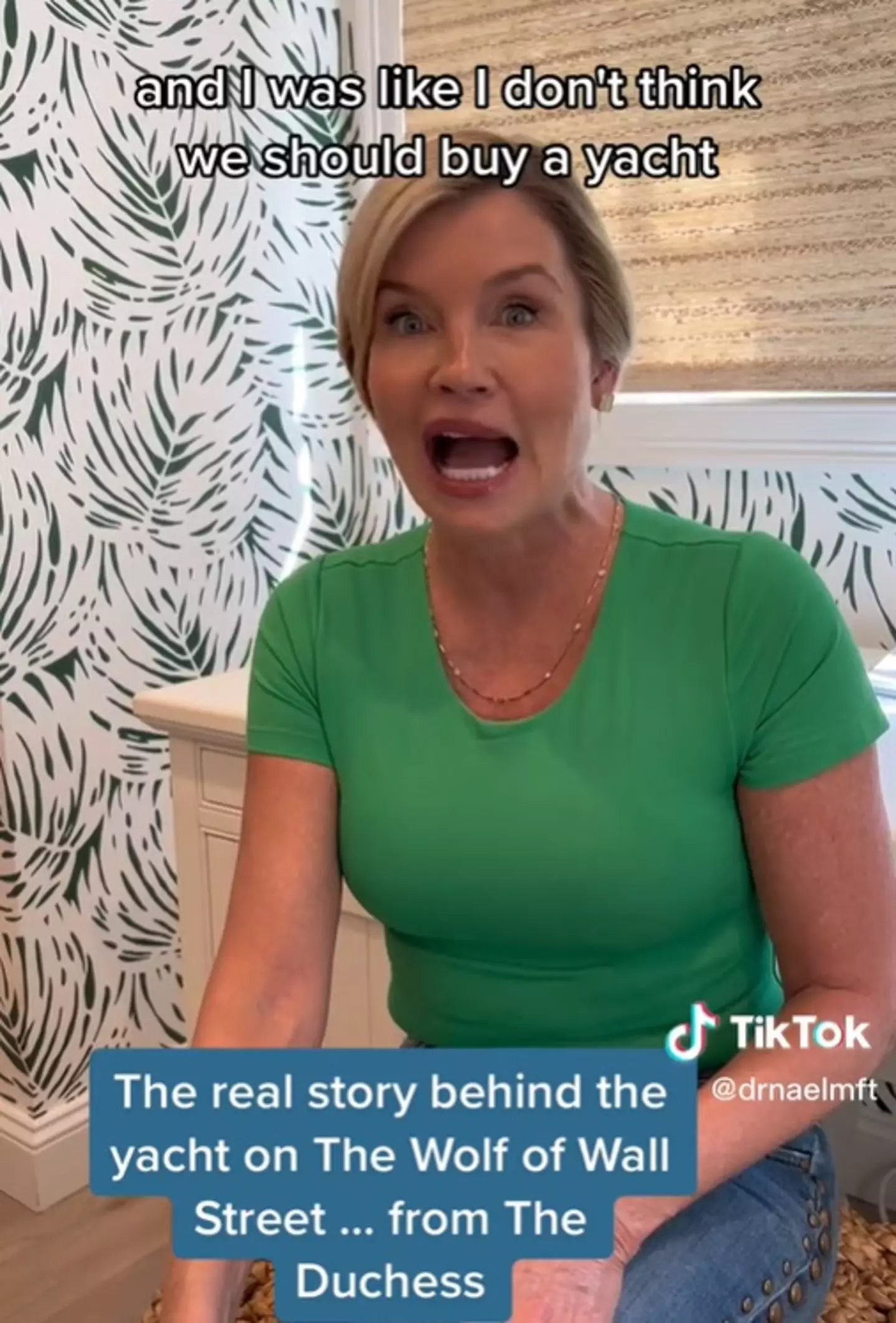

Jordan Belfort’s ex-wife tells the real story behind the yacht on The Wolf of Wall Street

The ex-wife of jordan belfort shed some light on the infamous scene.

Ben Thompson

Jordan Belfort's ex wife, Nadine Macaluso, has set the record straight about the scene in The Wolf Of Wall Street where Belfort splashes out and buys his wife a yacht on their wedding day.

I mean, when you have a lot of money , what better way to treat your new spouse after saying I do?

After their lavish wedding, Belford ( Leonardo DiCaprio ) covers Nadine's, or Naomi as she's known in the movie, eyes with a blindfold before revealing the huge yacht, which has been christened the 'Naomi'.

And Naomi (played by Margot Robbie ) cannot contain her excitement.

"Are you serious? A f***ing yacht?!" she exclaims.

However, it seems that the real Belfort wasn't very serious, as Macaluso revealed on TikTok that her ex-husband, who she was married to from 1991 to 2005, 'did not' actually buy her a boat on their wedding day.

She said: "Actually what happened I think we were married for a few years and we were always chartering yachts, because he loved to do that.

"And I had given birth to my beautiful daughter Chandler and he said 'I want to buy a yacht'."

However, this idea didn't sit well with Macaluso at the time.

She continued: "I said 'I don't think we should buy a yacht, we have a baby and I don't feel comfortable.

'She can't swim.'

"I had visions of her falling off the boat and I was actually terrified.

"I did not want to buy the yacht ironically. And he was like 'Nope, I'm buying a yacht and I'm calling it the Nadine'. And I was like 'Okay, here we go'.

"And you know how that went."

Macaluso's final line is a nod to a scene in the film, in which Belfort and Naomi need to be rescued from the yacht after it gets caught up in a storm.

This scene was indeed based on the real life sinking of the ship in June 1996, which resulted in a rescue by the Italian Navy Special forces.

The yacht was sunk after violent waves repeatedly hit it, but luckily everyone on board was able to escape the ship in time.

Macaluso has previously commented on the scene's accuracy , where she admitted in a TikTok video that the yacht sinking scene was 'totally true'.

Speaking of the memory, she said: "It was horrific, horrifying, we were in a squall for 12 to 18 hours and we lived, thank god, for my kids."

She even showed real life footage of her, Belford and their friends being rescued by the Navy.

Topics: TV and Film

Choose your content:

AI shows what Harry Potter characters could look like now

Voldemort has really had a glow-down.

Netflix fans obsess over the 'most unhinged' show they have just added

The show moved some viewers to tears.

Jim Carrey got so angry on film set director thought he might 'punch him in face'

The oscar-winning film starred jim carrey and kate winslet.

Scary Movie is being rebooted with a new reboot in the works

A new scary movie film is coming.

- Real Wolf of Wall Street's ex-wife gave Margot Robbie important advice about doing completely nude scene

- Real footage of the beach party from the Wolf of Wall Street shows how accurate the movie is

- Real Wolf of Wall Street’s ex-wife shares common ‘red flag’ that means your partner might be cheating

- Company Looking To Pay Someone €50 An Hour To Watch Wolf Of Wall Street

- San Lorenzo

- Yacht Rental in Dubai Marina

- Yacht Party Dubai

- Overnight Experience

- Formula 1 Abu Dhabi

- Corporate Events

- Fifa World Cup 2022

- Anniversary Celebrations

Connect with a yacht expert & get per personalised Deals

Jordan Belfort Yacht: The True Story and The Wolf of Wall Street Version

The true Jordan Belfort yacht story is as strange and unbelievable as the hit movie The Wolf of Wall Street depicts it to be. There are several insider stories behind the sinking of the mighty yacht that are not widely known but are quite interesting and different from the reel version in several ways.

What happened to the Jordan Belfort yacht Nadine?

As the movie, The Wolf of Wall Street shows, the superyacht Nadine sank close to the coast of Sardinia in 1997 while battling what many calls “the storm of the century”. Jordan Belfort narrates the event in detail in the memoir describing his life in the 90s, which is what the Martin Scorsese movie is about.

Before getting into the details of the sinking, it is worth noting that the 37m yacht had a long and interesting history. She carried renowned celebrities like Coco Chanel before reaching Jordan Belfort (played by Leonardo DiCaprio in the movie) and was one of the largest yachts in the East Coast’s waters.

While the yacht was initially manufactured for a French native and given the name Matilda, he backed out of the deal. This led Coco Chanel to buy the beautiful yacht with the low superstructure that Dutch yachts are famous for.

You can learn more about our yacht charter services in Dubai

The yacht took on different names as it passed through famous hands, even those of the murder trial acquitted Melvin Lane Powers. Belfort named the yacht after his wife and renovated it with the capacity to carry a helicopter, 6 Jetskis, 4 motorbikes, and much more. Under Belfort’s ownership, the yacht witnessed a series of wild parties that were like unlimited glamour and fun in a package until disaster struck unexpectedly.

Did the yacht scene in The Wolf of Wall Street actually happen?

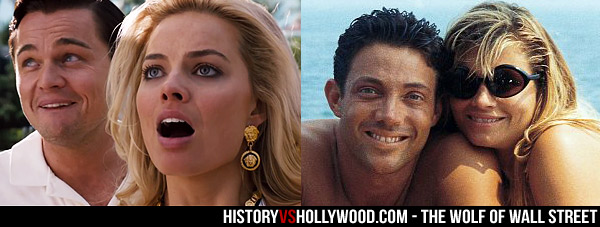

The Jordan Belfort yacht sinking scene in The Wolf of Wall Street was heavily inspired by a real-life event, though the movie did take some creative liberties. For one, the yacht was called Naomi in the reel version since the name of Belfort’s wife (played by Margot Robbie ) was changed in the movie. In reality, the yacht was named Nadine.

The movie further depicts Belfort’s helicopter getting thrown off the yacht by strong waves. In reality, the yacht’s crew went up to the deck and pushed off the helicopter so that Italian navy seals would have a space to land. The yacht’s itinerary was altered a bit by the movie’s director Martin Scorsese to add to the drama, though the power of the storm was scarily accurate.

Belfort admitted that the yacht’s captain Mark Elliot explicitly warned them not to sail to Sardinia on that fateful night. But according to the movie, there was a business opportunity in the city that Belfort could not bear to miss out on despite his wife’s protests.

Some sources claim that in reality, the passengers were simply eager to hit the golf course at Sardinia the next morning. They refused to pay heed to the captain’s warning and asked him to go through the storm, which eventually led to the famous Jordan Belfort yacht sinking incident. Therefore, unfortunately, if someone wants to have a yacht rental in Dubai or any other destination, they have missed their chance with this yacht.

Take a look on our Yacht Dubai Party

Interesting insights on the sinking as portrayed in the movie

The movie captures the fear and stress that each passenger felt when the yacht got caught up in the 70-knot storm. There is some hilarity when Belfort starts yelling for his drugs to avoid the horror of dying sober.

Several rescue attempts were made, but due to rising risks, each of them was called off. By some twist of luck, the yacht’s engine room remained mostly undamaged for a while, because of which they were able to make their way through the sea.

In the end, everyone survived the incident without any major injuries. At dawn, the Nadine made its way 1000m under the water only 20 miles away from Sardinia’s coast. Now, the movie’s audience gets to watch the Jordan Belfort yacht story unfold on the screen with a pinch of humor.

The Nadine’s captain Mark Elliot’s heroic actions did not go unnoticed. He was praised for leading all the passengers to safety, though he was able to get out of the yacht only 10 minutes before it sank. The captain also admitted that the insurance was granted immediately considering the ferocity of the storm. As for the yacht, many still wonder about the highly expensive equipment that had to be thrown into the water and is probably rusting away at the bottom of the sea.

The best features of the Jordan Belfort yacht Nadine

The 167 ft Nadine, as its former passengers claim, was a beautiful yacht. When owned by Coco Chanel under the name Matilda, the yacht had five staterooms, large dining areas, and a helipad. The interiors were furnished with dark teak paneling. Each new owner customized the yacht’s name and interiors based on their tastes.

Belfort decorated the Nadine lavishly with a variety of mirrors and set a vintage deco theme. He renovated the upper deck to fit a crane that was able to stow his Turbine Seawind seaplane. The yacht carried the best dive gear available in the market plus a variety of Belfort’s ‘toys’ such as his motorbikes and jetskis.

Which model was portrayed as the Jordan Belfort yacht Nadine in the movie?

Martin Scorsese got the yacht Lady M to represent Nadine onscreen. While Nadine actually had a luxuriously vintage charm to it, Lady M is a modern vessel with contemporary features. Lady M was manufactured in 2022 by Intermarine Savannah, while Nadine was built in 1961 by Witsen & Wis. The 147 ft Lady M is currently worth $12 million and is similar to Benetti yachts in its glamorous design.

Jordan Belfort’s life today

The entrepreneur and speaker Jordan Belfort’s shenanigans are well-known thanks to his detailed memoir and the hit movie based on some parts of his life. He spent 2 years in prison and now, at 59 years of age, has a practically negative net worth. Yet, his extraordinary motivational speaking skills continue to attract and inspire people even today.

It is easy for anyone watching the movie to wonder if many of the incidents are exaggerated. But considering Belfort’s eccentric life, even the Nadine sinking incident remains another regular anecdote shared in the movie.

PER HOUR Per Day

Browse our Yachts

The Real Story Behind the Yacht in The Wolf of Wall Street

Based on the eponymous memoir, the 2013 hit The Wolf of Wall Street told the story of Jordan Belfort, a former stockbroker who was convicted of securities fraud and money laundering. Directed by Martin Scorsese and starring Leonardo DiCaprio, the movie was a smashing success through and through. Amongst its many impressionable scenes, one of the most memorable ones was the yacht party, where Belfort and his colleagues indulged in lavish excess. However, Belfort’s ex-wife, Nadine Caridi, has now spoken out about the real story behind the yacht.

Nadine Caridi, the Ex-Wife

Caridi, who was portrayed in the movie by Margot Robbie, gave an interview in which she revealed that the yacht scene was not entirely accurate. According to Caridi, the yacht that was shown in the movie was not the one that Belfort actually owned. Instead, it was rented for the filming of the scene. In reality, Belfort owned a different yacht called Nadine. Caridi claims that the yacht was named after her and that she played a significant role in its design and decoration. She says that the yacht was much smaller than the one shown in the movie, but it was still luxurious and served as a symbol of Belfort’s wealth.

The Sinking of the Nadine Yacht

Nadine Caridi recently spoke about the sinking of the yacht in June 1996, an event that inspired a scene in the movie. The yacht’s sinking during a storm off the coast of Italy was a terrifying experience for everyone on board. The waves were violent and relentless, hitting the yacht repeatedly. Rescue services had to be called in to rescue the passengers and crew, including Belfort and Caridi. In a recent TikTok video, Caridi shared real-life footage of the rescue, showing the fear and chaos that ensued during the storm, while expressing gratitude that everyone survived.

Everything The Wolf Of Wall Street Doesn't Tell You About The True Story

Martin Scorsese's film "The Wolf of Wall Street" is an over-the-top celebration of greed and excess, inspired by the memoir of the notorious stockbroker Jordan Belfort, who is played by Leonardo DiCaprio in the film. It tell of the rise of Jordan Belfort from a low-level assistant at L. F. Rothschild to a Long Island penny stock pusher, as well as Belfort's dramatic fall from filthy rich CEO of Stratton Oakmont to a stint in federal prison for stock fraud and money laundering.

Despite being ostensibly based on a true story, many question the veracity of the film because of how absolutely outlandishness of Belfort's claims, and how outrageous the antics at Stratton Oakmont are. Scorsese obviously recognized Belfort is an unreliable narrator with a penchant for exaggeration. In the film, Belfort breaks the fourth wall, addressing the camera and the audience directly. This was a strategic choice by the screenwriter and director. Screenwriter Terence Winter told Esquire , "Jordan is talking directly to you. You are being sold the Jordan Belfort story by Jordan Belfort, and he is a very unreliable narrator. That's very much by design."

Despite how unlikely this story is, most of what transpires in the film actually happened. Winter added, "I assumed he must've been embellishing. But then I did some research, and I talked to the FBI agent who arrested him, who had been tracking Jordan for ten years. And he told me, 'It's all true. Every single thing in his memoir, every insane coincidence and over-the-top perk, it all happened.'"

That said, this film is Belfort's truth, not necessarily the definitive truth. Keep reading if you want to learn everything "The Wolf of Wall Street" doesn't tell you about the true story of Jordan Belfort's meteoric rise and fall.

Belfort's wives' names were changed for the film

Although their real-life counterparts are obvious, the names of Jordan Belfort's ex-wives were changed in the film, giving the filmmaker creative license with the characters. Belfort's first-wife in the film is Teresa Petrillo (Cristin Milioti), but her real-life counterpart is Denise Lombardo. Denise met Belfort in high school, and the childhood sweethearts married in 1985 after Denise graduated from college. Belfort founded Stratton Oakmont while married to Denise, and they divorced after she found out about his affair in 1991 (per The U.S. Sun ). After their divorce, Denise led a low-profile life, staying out of the public eye.

Belfort's second-wife in the film is Naomi Lapaglia (Margot Robbie). Naomi's real-life counterpart is Nadine Macaluso. Like Naomi, Nadine was a model and met Belfort at a party before they married in 1991. Nadine and Belfort had two children together and separated in 1998 as depicted in the film (per the U.S. Sun). Nadine got a Ph.D, becoming a marriage and family therapist. She lives in California with her second husband (per Daily Mail TV ).

Margot Robbie , who played Naomi in the film, met Nadine while preparing for her role. Robbie told IndieWire meeting Nadine helped her understand her character's motivations, saying, "I could do or say any horrible thing and know that my character's motivation was out of protection for her child. Whether or not the audience sees my side of events is another matter, but just to know my motivation can give me an authentic performance." She added how strong Nadine is, saying, "She's has to be, to have put up with Jordan and his shenanigans."

The original crew Belfort recruited from friends are composite characters

Although Belfort recruited the original crew for his Long Island brokerage firm from a group of friends; Alden "Sea Otter" Kupferberg (Henry Zebrowski), Robbie "Pinhead" Feinberg (Brian Sacca), Chester Ming (Kenneth Choi), and Nicky "Rugrat" Koskoff (PJ Byrne) are composite characters with fictitious names. These characters are an amalgamation of numerous people who worked at Stratton Oakmont and do not represent actual people.

This didn't stop Andrew Greene, a board member of Stratton Oakmont, from filing a defamation suit against the film's production company. He was offended by the depiction of "Rugrat" in the film, saying the character damaged his reputation. He called the character a "criminal, drug user, degenerate, depraved and devoid of any morals or ethics" (per The Guardian ).

In 2018, Greene lost his suit . In 2020, an appellate court threw the suit out, stating that the filmmakers, by creating composite characters and fictitious names, "took appropriate steps to ensure that no one would be defamed by the Film," (per the Hollywood Reporter ). The filmmaker included the hijinks of the employees at Stratton Oakmont in the film to illustrate the raucous corporate culture of the brokerage firm, rather than defame former employees.

Donnie Azoff doesn't exist, his real-life counterpart is Danny Porush

Jonah Hill 's character Donnie Azoff in "The Wolf of Wall Street" doesn't exist. He is a composite character created to avoid defaming anyone while making the film. To anyone who is familiar with Jordan Belfort and Stratton Oakmont's story, it's obvious Danny Porush is Azoff's real-life counterpart. Porush disputes the veracity of both Belfort's memoir and the film, telling Mother Jones , "The book ... is a distant relative of the truth, and the film is a distant relative of the book." Porush admits to swallowing the goldfish, but under different circumstances than depicted in the film.

As reported by Mother Jones, Porush was Belfort's friend and business partner between 1988 and 1996. Like Belfort, he cooperated with authorities, ultimately serving 39 months in prison for his securities and financial crimes at Stratton Oakmont. Porush disputes the throwing of dwarves, insists there were never animals in Stratton Oakmont — other than the goldfish he ate — but admits to the wild parties and taking part in the depravity and excesses encouraged at the brokerage firm, saying "Stratton was like a fraternity."

Porush told Mother Jones, "My main complaint [regarding the memoir] besides his inaccuracy was his using my real name," something that was remedied when the filmmakers created the composite character of Donnie Azoff. Ultimately, Porush doesn't seem to hold a grudge despite his grievances with the inaccuracies saying, "Hey, it's Hollywood ... I know they want to make a movie that sells. And Jordan wrote whatever he could to make the book sell."

Danny Porush's wife introduced Jordan Belfort to her husband

In "The Wolf of Wall Street," Donnie Azoff (Danny Porush's fictional counterpart) approaches Belfort at a restaurant about what he does for a living, after seeing Belfort's Jaguar in the parking lot. In reality, Belfort met his future business partner, Danny Porush, through Danny's wife Nancy.

Porush and Nancy lived in the same building in Queens where Belfort lived with his first wife Denise, as Nancy told Doree Lewak with The New York Post in 2013 shortly before "The Wolf of Wall Street" came out. Nancy explained how she took the same bus into the city for work as Belfort, saying, "the commute to the city each day was hard because I became pregnant right away. There was a nice boy from our building on the same bus who always gave up his seat for me. His name was Jordan Belfort, and he worked in finance ... I pushed Danny to talk to Jordan ... After just one conversation, Danny came back and announced he was taking the Series 7 exam to get his stockbroker's license."

In the New York Post article, Nancy detailed how her husband changed once he began working with Belfort and making serious cash, saying, "Up until then, Danny never seemed to care about money ... I saw him morph from a nice wholesome guy into showy narcissist whom I hardly recognized anymore." After being arrested for securities fraud, Porush left Nancy for another woman. They are now divorced, and he lives in Florida with his second wife. We can't help wondering if Nancy ever regrets introducing her ex-husband to Belfort.

Belfort's destroyed yacht once belonged to Coco Chanel

Jordan Belfort bought a yacht and named it after his second wife. In the film, the boat is named Naomi after the character played by Margot Robbie, but in real life the boat was called the Nadine . True to the film, Belfort insisted his boat's captain take the yacht into choppy waters, where the boat happened upon powerful but unpredictable mistrals, leading to the Nadine sinking into the Mediterranean Sea in an event known as Mayday In The Med . Belfort, his guests and crew, were rescued by the Italian coast guard.

What the film doesn't tell you is that Belfort's yacht had an interesting past. Belfort's vintage yacht once belonged to none other than the famous French fashion designer Coco Chanel. Chanel is known for her outspoken nature and is associated with quite a few fiercely female quotes. Chanel is quoted as saying , "As soon as you set foot on a yacht, you belong to some man, not to yourself, and you die of boredom." Rather than avoid luxury yachts all together, Chanel made the boss move of buying her own in 1961, naming her the Matilda (per Boss Hunting ).

As bizarre as this interlude of the film was, it actually happened, with one major difference. In an interview with The Room Live , Belfort explained how the group waiting to be rescued had to push the helicopter off of the boat to make room for a rescue team to lower down onto the yacht. In the film, the waves knock the helicopter off of the yacht. Belfort also explains that although his private jet also crashed, it was 10 days after the yacht sunk, not at the same time, as it was depicted in the film for dramatic effect.

Steve Madden spent time in prison for stock fraud

Although they don't talk about it in the movie, Steve Madden also went to prison for stock fraud and money laundering along with Jordan Belfort and Danny Porush. The New York Times reported in 2002 that Madden "was arrested in 2000 as a result of an investigation of a scheme to manipulate 23 initial public stock offerings underwritten by the companies Stratton Oakmont and Monroe Parker Securities ... It included the initial public stock offering of his own company in 1993."

True to the film, Danny Porush, Azoff's real-life counterpart, really was childhood friends with Steve Madden. Like Belfort and Porush, Madden loved debauchery and Quaaludes, so much so he didn't finish college because of how much he was partying. Although Madden wrote about his wild days in his memoir, his time partying with the Stratton Oakmont "fraternity" was not included in the film. Stratton Oakmont took Madden's company public, making him instantly rich ( per The New York Post ).

As reported by the New York Post, Madden wrote about this period of his life in his memoir "The Cobbler: How I Disrupted an Industry, Fell from Grace & Came Back Stronger Than Ever." In his book, Madden wrote, "Jordan was like no one else I have ever met before or since. He became one of the most influential people in my life ... I was pumping and dumping [stocks] right alongside them." Madden wound up serving 31 months for his financial crimes and his involvement with Stratton Oakmont's schemes. Unlike Porush and Belfort, Madden could continue working at his company after being released from prison.

Belfort was ordered to pay restitution to his victims

When Belfort was convicted of money laundering and stock fraud in 2003 for Stratton Oakmont's "pump and dump" schemes, he was sentenced to four years in prison and ordered to pay over $110.4 million in restitution (per Crime Museum ). Belfort only served 22 months for his crimes and a judge ordered him to pay half of his income once he was released from prison.

In 2013, just after the film was released, CNN reported Belfort had only contributed a little over $11 million to the fund for victims, much obtained from confiscated possessions. At the time the film came out, Belfort allegedly stated he would hand over all of his royalties from the film and the book. But in 2018, Fortune Magazine reported government officials claimed Belfort still owed $97 million, meaning that over the previous 5 years, Belfort only contributed an additional $2 million dollars to the victims' fund. $2 million dollars is more than most of us will ever see, but Belfort is still making good money as a motivational speaker.

As reported by Fortune Magazine, there is a disagreement between Belfort's attorneys and prosecutors over what income can be garnished for restitution. Belfort reportedly earned around $9 million dollars between 2013 and 2015, but neglected to pay half of those earnings to the victims' fund. Although Belfort claims he will feel better after he has paid the money back, he doesn't seem to be fulfilling his end of the court order. Belfort obviously still enjoys a life of luxury and it is hard to reconcile his claims of being reformed with his reluctance to pay the restitution to his victims. In her New York Post article Nancy Porush reminded us, "Greed is not good — it's ugly."

Tommy Chong was Belfort's cellmate in prison

"The Wolf of Wall Street" ends with Jordan Belfort in a cushy white-collar prison with tennis courts, but the film didn't tell us who Belfort's cellmate was. Belfort and Tommy Chong of the comedy duo "Cheech & Chong" were cellmates before Chong was released. In 2014, Belfort spoke to Stephen Galloway with The Hollywood Reporter about his time in prison. He explained, "[Chong] was in the process of writing his book. We used to tell each other stories at night, and I had him rolling hysterically on the floor. The third night he goes, 'You've got to write a book.' So I started writing, and I knew it was bad. It was terrible. I was about to call it quits and then I went into the prison library and stumbled upon 'The Bonfire of the Vanities' by Tom Wolfe, and I was like, 'That's how I want to write!'"

In 2014 Chong spoke with Adrian Lee at Maclean's about how he met Belfort in prison and giving Belfort feed back on his pages, saying "After a while he showed me what he had written, and it was the only time I had critiqued someone really heavy — usually when someone writes something, you say, 'Oh yeah, that's great, keep going.' But I knew instinctively he had a lot more to offer than what he showed me ... I told him ... 'No, you've got to write those stories you've been telling me at night. Your real life is much more exciting than any kind of imaginary story you could come up with.'"

Stratton Oakmont was never on Wall Street

Although the memoir and film are titled "The Wolf of Wall Street," Jordan Belfort only worked on Wall Street for several months in 1987 at L. F. Rothschild. Black Monday put an end to his days at a Manhattan based brokerage firm. As we see in the film, it was on Long Island that Belfort got a job at the Investor's Center selling penny stocks from the pink sheets and found his calling: his get-rich-quick scheme, selling nearly worthless stocks for a 50 percent commission to people who couldn't afford to lose the money (per NY Times ).

Belfort soon went out on his own, founding Stratton Oakmont with Danny Porush, where they began targeting rich investors using a persuasive script and "pump and dump" tactics — making Belfort, Porush and their brokers rich, while leaving their clients broke. As reported by the Washington Post in 1996, Stratton Oakmont was disciplined for securities violations as early as 1989, and continued to be disciplined almost annually.

Jimmy So with The Daily Beast, maintains, "The problem with 'The Wolf of Wall Street' is that the self-fashioned wolf was nowhere near the real Wall Street." The memoir and film made the brokerage firm seem like a much bigger deal than they really were, despite the financial ruin they left in their wake. Stratton Oakmont's offices were on Long Island, not Wall Street.

Jordan Belfort was never called 'The Wolf of Wall Street'

Scorsese's film makes it seem like Forbes gave Jordan Belfort the nickname, "The Wolf of Wall Street" when they published a takedown about Stratton Oakmont's questionable business practices. Forbes wrote an article about Stratton Oakmont's dirty deeds in 1991, but the article did not call Belfort "the wolf of wall street." In 2013, Forbes revisited Roula Khalaf's original article, where she called Belfort a "twisted Robin Hood who takes from the rich and gives to himself and his merry band of brokers."

Danny Porush, Belfort's former partner and one-time friend, told Mother Jones that nobody at the firm ever used the "wolf" moniker. As reported by CNN , Belfort came up with the nickname himself for his memoir. As Porush told Mother Jones, Belfort's "greatest gift was always that of a self-promoter." But as Joe Nocera with the NY Times said, "who would ever buy a ticket to a movie called 'The Wolf of Long Island'?"

Belfort had a head-on collision while driving under the influence of Quaaludes

When the real Jordan Belfort crashed his car while on Quaaludes, he was in a Mercedes Benz rather than a Lamborghini, and someone was actually injured. Belfort had a head-on collision while driving home from the country club where he used the pay phone, sending the woman he collided with to the hospital (per The Daily Beast ). None of Belfort's crimes are victimless.

This type of discrepancy is central to the complaints about both Belfort's memoir and the film. Although Belfort says he regrets his crimes, he is too busy boasting about the parties, the riches, the drugs, and the sex to sound like he regrets anything except getting caught. Belfort's memoir and the film it inspired might seem like a celebration of greed and excess, but they are also a depiction of the ostentatious behavior that eventually drew the attention of the authorities.

Scorsese's "The Wolf of Wall Street" might not tell you everything about the true story, but what it does is reveal how audiences love watching someone else's destructive behavior. We get all the thrills and none of the consequences. As screenwriter Terence Winter told Esquire, "I'd much rather watch somebody who isn't responsible, who makes all the wrong decisions and hangs out with the wrong people. That's more satisfying. We may live like saints, but when it comes to our fantasy life, everybody's got a little larceny in their soul."

- Login or Register

Jordan Belfort Yacht: The True Story and The Wolf of Wall Street Version

luxuo guide

Share This Article

The true Jordan Belfort yacht story is as strange and unbelievable as the hit movie The Wolf of Wall Street depicts it to be. There are several insider stories behind the sinking of the mighty yacht that are not widely known but are quite interesting and different from the reel version in several ways.

Nadine yacht model

What happened to the Jordan Belfort yacht Nadine? As the movie, The Wolf of Wall Street shows, the superyacht Nadine sank close to the coast of Sardinia in 1997 while battling what many calls “the storm of the century”. Jordan Belfort narrates the event in detail in the memoir describing his life in the 90s, which is what the Martin Scorsese movie is about.

Jordan belfort yacht sailing

Did the yacht scene in The Wolf of Wall Street actually happen? The Jordan Belfort yacht sinking scene in The Wolf of Wall Street was heavily inspired by a real-life event, though the movie did take some creative liberties. For one, the yacht was called Naomi in the reel version since the name of Belfort’s wife (played by Margot Robbie) was changed in the movie. In reality, the yacht was named Nadine.

Interesting insights on the sinking as portrayed in the movie

The movie captured each passenger’s fear and stress when the yacht got caught up in the 70-knot storm. There is some hilarity when Belfort starts yelling for his drugs to avoid the horror of dying sober. Several rescue attempts were made, but each was called off due to rising risks. By some twist of luck, the yacht’s engine room remained undamaged primarily for a while, because of which they were able to make their way through the sea.

The best features of the Jordan Belfort yacht Nadine

The 167 ft Nadine, as its former passengers claim, was beautiful. When owned by Coco Chanel under the name Matilda, the yacht had five staterooms, large dining areas, and a helipad. The interiors were furnished with dark teak paneling. Each new owner customized the yacht’s name and interiors based on their tastes.

Which model was portrayed as the Jordan Belfort yacht Nadine in the movie?

Martin Scorsese got the yacht Lady M to represent Nadine onscreen. While Nadine had a luxuriously vintage charm, Lady M is a modern vessel with contemporary features. Lady M was manufactured in 2022 by Intermarine Savannah, while Nadine was built in 1961 by Witsen & Wis. The 147 ft Lady M is currently worth $12 million and is similar to Benetti yachts in its glamorous design.

Jordan Belfort’s life today

The entrepreneur and speaker Jordan Belfort’s shenanigans are well-known thanks to his detailed memoir and the hit movie based on some parts of his life. He spent 2 years in prison and now has practically negative net worth at 59 years of age. Yet, his extraordinary motivational speaking skills continue to attract and inspire people even today. It is easy for anyone watching the movie to wonder if many of the incidents are exaggerated. But considering Belfort’s eccentric life, even the Nadine sinking incident remains another regular anecdote shared in the movie.

Leave a comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

You May Also Like

Richard montañez’s inspiring journey and net worth, unveiling jared fogle: from subway success to scandal.

© 2024 Truth. All Rights Reserved.

- Newsletters

- Account Activating this button will toggle the display of additional content Account Sign out

How Accurate Is The Wolf of Wall Street ?

For The Wolf of Wall Street , his latest collaboration with Leonardo DiCaprio, Martin Scorsese forewent his signature voiceover style in favor of more direct address: Throughout the movie, DiCaprio, playing the lupine financial huckster Jordan Belfort, looks into the camera and speaks right to the audience. Terence Winter, who wrote the screenplay, explains the use of the technique thusly: “ You are being sold the Jordan Belfort story by Jordan Belfort , and he is a very unreliable narrator.”

It’s important to keep that in mind if you decide to dig into the fact and fiction of the film. The Wolf of Wall Street is quite faithful to the book by Belfort that it’s based on —though there are differences; the key ones are enumerated below. But how faithful is that book to reality?

It can be hard to tell, especially since some of its more outlandish tales turn out to be true. Nonetheless, below is an attempt to suss out the true-to-life from the merely true-to-Belfort in the film version of his story.

Jordan Belfort (Leonardo DiCaprio)

Leonardo DiCaprio, left, as Jordan Belfort, right

Courtesy of Paramount Pictures / Photo by Michael Loccisano/Getty Images

The broad outlines of Belfort’s story are faithfully rendered by the film: A talented but struggling salesman from Long Island, he got a job at venerable investment firm L.F. Rothschild, then was laid off after Black Monday . He went to work at Investors Center, a penny stock house, and a year later opened “ a franchise of Stratton Securities , a minor league broker-dealer,” in “a friend’s car dealership in Queens.” He and his partner earned enough to buy out Stratton and form Stratton Oakmont, which he built into one of the largest over-the-counter brokerage firms in the country. (As in the movie, he hired some old friends .) He did an enormous amount of drugs—including, yes, Lemmon 714s —employed the services of countless prostitutes, and eventually went to prison for the pump-and-dump schemes that made him rich.

Much of DiCaprio’s dialogue comes straight from Belfort’s book, as do nearly all of the hard-to-believe misadventures: landing the helicopter on his lawn while stoned, crashing his car while severely high on Quaaludes, insisting that the captain of his massive yacht sail through choppy waters only to have the boat capsize and then get rescued by the Italian navy. Some of these stories are difficult to verify, but, for what it’s worth, the FBI agent who investigated Belfort told the New York Times , “I tracked this guy for ten years, and everything he wrote is true .” (Even the yacht story checks out .) As for the much discussed tossing of little people, shown at the beginning of the movie: Belfort’s second-in-command says “ we never abused [or threw] the midgets in the office ; we were friendly to them.” That same former exec says there were never any animals in the office, let alone a chimpanzee, and he says that no one called Belfort “the Wolf.” We know, at least, that the nickname was not coined by a Forbes writer . But, for the most part, it’s Belfort’s word against his.

As far as I can tell, Belfort is not a particular advocate of “ sell me this pen ,” a bit of sales interview role-playing that has been around for years . Another minor but notable difference between movie and reality: Belfort, unlike DiCaprio, is a short man, and multiple acquaintances have suggested that his lust for money, power, and attention are evidence of a Napoleon complex . As for the fidelity of DiCaprio’s portrayal otherwise, there are many videos of Belfort you can watch online, including one or two of Stratton Oakmont company parties .

Danny Porush/Donnie Azoff (Jonah Hill)

Photo courtesy Mary Cybulski/Paramount Pictures; Photo courtesy DannyPorush.com

The case of Donnie Azoff (Jonah Hill) is more complicated. For one thing, Azoff is a fictional name, and the character is sometimes described as a composite. His story closely matches that of Danny Porush—but Porush himself has disputed some of the details . Here are the basic facts: Porush lived in Belfort’s building, and he went to work as a trainee under Belfort before Stratton Oakmont. As History vs. Hollywood notes, he did not meet Belfort in a restaurant ; they were introduced by Porush’s wife (and yes, she was his cousin ; they have since divorced). He has admitted to eating a live goldfish that belonged to a Stratton employee, as depicted in the memoir and the movie, but denies the three-way with Belfort and a teenaged employee .

Porush was indeed a childhood friend of Steve Madden’s, and the initial public offering for that women’s shoe company was the biggest bit of business Stratton Oakmont ever did. Madden, like Porush and Belfort, served time in prison for participating in the Stratton scheme.

Nadine/Naomi (Margot Robbie)

Photo courtesy Mary Cybulski/Paramount Pictures; Home video still/CNN/YouTube

The names of Belfort’s wives were also changed for the film. Belfort divorced Denise Lombardo, called Teresa in the movie, after meeting Nadine Caridi at a Stratton Oakmont party . Caridi, called Naomi and played by Margot Robbie, was a model who had appeared in beer commercials; in the book, Befort calls her “the Miller Lite girl.” (You can see one of her ads below.) In both the book and the movie Belfort calls her the Duchess of Bay Ridge (or just the Duchess, for short), because she was born in England but grew up in Bay Ridge, Brooklyn. She really did have an English aunt (named Patricia, not Emma) who smuggled money into Switzerland on Belfort’s behalf, and who died while Belfort’s money was still in Swiss banks. (Belfort also had a drug-dealing friend with Swiss in-laws who did much of the smuggling—and that friend was later arrested after a botched money hand-off with Porush , just as we see in the movie.)

The scene in which Naomi spreads her legs open and tells Jordan he won’t be getting sex any time soon , only to learn that she is in full view of a security camera, is taken right from the book—as is the fight in which she throws water at her husband repeatedly. Belfort acknowledges hitting his wife in the memoir; he says he kicked her down the stairs. He also threatened to take their daughter away, putting her in the car with him and then crashing it into a pillar on their property. He was high.

Belfort and Caridi have since divorced.

Mark Hanna (Matthew McConaughey)

Graphic by Slate. Images courtesy courtesy of YouTube, Paramount Pictures.

The L.F. Rothschild trader who takes Jordan to lunch and tells him that cocaine and masturbation are the keys to success as a stockbroker is based on a real person whose name is not changed in the movie or the book. Mark Hanna has told his own version of the story on YouTube , and he does not seem to dispute the substance of Belfort’s account. (The lunch scene in the film combines two conversations from the memoir, using nearly identical dialogue.) Hanna himself was later convicted of stock fraud . He did not pound his chest and hum rhythmically, as McConaughey does so memorably in the movie; that flourish is based on an acting exercise that McConaughey likes to do , and was, according to the movie’s press notes, incorporated into the film after DiCaprio and Scorsese noticed the actor doing it on set.

Special Agent Gregory Coleman/Patrick Denham (Kyle Chandler)

Courtesy WolfofWallStreet.com/Photo courtesy Mary Cybulski/Paramount Pictures

Patrick Denham is another made-up name, but there really was an FBI agent who followed Belfort closely for years: Gregory Coleman. He told CNBC in 2007 that he was struck by the “ blatantness ” of Belfort’s financial crimes. As far as I can tell, they did not meet on Belfort’s yacht, as the movie suggests ; in the book, Belfort first meets Coleman when the FBI arrives to arrest Belfort at his home. (The arrest did not take place while Belfort filmed an infomercial—that’s a bit of poetic license on Scorsese’s part.)

The Aftermath After his arrest and indictment, Belfort cooperated with the FBI. In the film, Jordan, while wearing a wire, passes a note to Donnie telling him not to incriminate himself. Belfort did not pass such a note to Porush, but, in his second book, Catching the Wolf of Wall Street , he claims to have done just this for his friend Dave Beall . He ultimately served 22 months in prison and was ordered to pay over $100 million in restitution to his victims ( which he has apparently failed to do ). As the film depicts, he became a motivational speaker after leaving prison; at the seminar in the movie, DiCaprio as Jordan is introduced by the real Jordan Belfort (and, in real life, the actor has filmed a testimonial for Belfort ). Belfort is not the only real-life participant to show up in the movie: A private investigator that Belfort employed, Richard “Bo” Dietl, is also in the film; he plays himself.

Previously How Much of American Hustle Actually Happened? The People Who Inspired Inside Llewyn Davis How True Is Saving Mr. Banks ? How Accurate Is 12 Years a Slave ? How Accurate Is Captain Phillips ? How Accurate Is Dallas Buyers Club ?

Who is Jordan Belfort? True Story of “The Wolf of Wall Street”

The guide will examine the life and fraudulent activities of Jordan Belfort , whose real-life events inspired the movie “ Wolf of Wall Street “. It will delve into Belfort’s career, particularly his time at Stratton Oakmont and the financial schemes that eventually led to his downfall.

Best Crypto Exchange for Intermediate Traders and Investors

Invest in 70+ cryptocurrencies and 3,000+ other assets including stocks and precious metals.

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

Copy top-performing traders in real time, automatically.

eToro USA is registered with FINRA for securities trading.

Related reads:

Who is Bernie Madoff? History’s Largest Ponzi Scheme Explained

Who Started Bitcoin? The True Story of Satoshi Nakamoto

Who is Robert Kiyosaki? The Story of “Rich Dad Poor Dad”

Who Is Michael Burry? “The Big Short” Briefly Explained

Who is Jordan Belfort?

Belfort spent 22 months in prison, during which he found his passion for writing. Soon after his release, he published his first memoir, “The Wolf of Wall Street,” recounting his time as a stockbroker, later popularized in the 2013 Martin Scorsese film, in which he is depicted by Leonardo DiCaprio.

After various scandals and a term in prison for fraud, Jordan Belfort has reinvented himself as a motivational speaker, his primary topic being the distinction between greed, ambition, and passion on Wall Street.

Jordan Belfort’s early life

Jordan Belfort was born in 1962 in the Bronx, New York City, to Jewish parents, who were both accountants. Around 16, Belfort and his close childhood friend earned $20,000 selling Italian ice from styrofoam coolers at a local beach.

After graduating from American University with a degree in biology, Belfort planned on using the money earned selling ice cream to pay for dental school, subsequently enrolling himself at the University of Maryland School of Dentistry. However, he dropped out on the first day after the school dean warned the students saying: “The golden age of dentistry is over. If you’re here to make a lot of money, you’re in the wrong place.”

Jordan Belfort’s personal life

While Jordan Belfort had a tumultuous business life and a flair for corrupt practices, his personal life wasn’t far from it. While running his company Stratton Oakmont, Belfort was already divorced from his first wife, Denise Lombardo. Jordan Belfort’s first wife, Denise Lombardo, whose movie character in “Wolf of Wall Street,” was played by Cristin Milioti.

You may also recognize the name Naomi, Jordan Belfort’s wife, portrayed by Margot Robbie in the movie “Wolf of Wall Street.” In real life, Naomi’s name is Nadine Caridi, Belfort’s second wife . Nadine and Jordan Belfort had two kids together (or Belfort and Naomi in the movie), but ultimately divorced in 2015 after domestic violence accusations.

Belfort’s ex-wife Nadine now goes by the name of Nadine Macaluso and works as a therapist, using her experience to help other women in abusive relationships via social media. Nadine has said she “ walked away from my marriage with absolutely nothing ,” reasoning “ it was the right thing to do ,” after realizing Belfort’s money was all “blood money.”

@drnaelmft I left my marriage from The Wolf of Wall Street with my kids and my curtains. #wolfofwallstreet #wolfofwallstreetmovie #wallstreet #nadinemacaluso #drnadinemacaluso #drnae #drnadine #marriedtothewolfofwallstreet #margotrobbie #margotrobbieofficial #tiktok #tiktokviral #tiktoker #tiktoknews #tiktokcelebsnews #tiktokfamous #naomiwolfofwallstreet #wolfofwallstreetnaomi #leonardodicaprio #leonardodicaprioedit #martinscorsese #martinscorsesefilms #martinscorsesemoviesbelike #icon #tiktoktherapist #tiktoktherapy #therapy #therapist #90s #longisland #wallstreet #wallstreet90s #goldcoast ♬ You Found Me – Instrumental Pop Songs

Jordan Belfort’s yacht was named after his second wife Nadine (or Naomi in the “Wolf of Wall Street” movie), which was previously built for Coco Chanel in 1961. It ultimately sank off the Sardinian east coast in 1996 after Belfort insisted on sailing out in high winds against the captain’s advice.

Jordan Belfort’s net worth

It is estimated that Jordan Belfort’s net worth peak was around $400 million in 1998; however, the exact figures are unknown. Despite his fraudulent past, Jordan Belfort has leveraged his years working in the financial industry, engaging in different ventures.

Motivational speaking, book sales, movie rights, as well as various real estate, stocks, and crypto investments, have accumulated Jordan Belfort a sizeable fortune, which as of March 2023, was estimated to be around an impressive $134 million .

A large chunk of Belfort’s annual income of $18 million comes from book sales (a book titled “The Wolf of Wall Street”) and motivational speaking events worldwide, where he shares his story of triumph and failure. He also makes an impressive $50 million by selling the movie rights to his story.

Furthermore, Belfort has invested roughly $27 in luxury real estate, owns multiple high-end cars worth $4 million, has an estimated cash reserve of over $32 million, and has an investment portfolio valued at around $15 million, adding crypto-related products.

Jordan Belfort’s podcast

Besides working as a motivational speaker and earning money through books and movies, Belfort keeps sharing his doings through a personal YouTube channel called The Wolf of Wall Street, where he posts monthly episodes of a podcast, “The Wolf’s Den,” where he shares his business ventures, motivational speaking events, life events, and new partnerships.

For example, in his session from January 13th with Robert Beadles, speaking to the founder of the Monarch crypto wallet, he shared his outlook on Bitcoin and the current crypto market and discussed the new regulations surrounding Bitcoin outlook for 2023 and the likely events that would follow.

Jordan Belfort’s career

Early endeavours.

At 23, Jordan Belfort became a door-to-door meat and seafood salesman on New York’s Long Island, dreaming of getting rich. He grew his business to a string of trucks and several employees, moving 5,000 pounds of beef and fish a week. But as he expanded too fast, the lack of capital ultimately failed the business, and he filed for bankruptcy at 25.

Wall Street

After the meat and seafood business went bust, Belfort’s interest turned to Wall Street, where he got a position as a trainee stockbroker at L.F. Rothschild. However, he was later let go after the company experienced financial difficulties due to the Black Monday stock market crash of 1987 .

Stratton Oakmont

Jordan Belfort eventually ended up at Investor Center, a small brokerage firm on Long Island, in 1988. There, he was introduced to penny stocks (high-risk securities with small market caps that typically trade for a low price over-the-counter (OTC) and are therefore less regulated than stocks traded on a major market exchange), which would later propel him to success.

A year later (1989), Belfort started an over-the-counter brokerage house in the franchise “Stratton Securities” with partner Danny Porush. Within five months, the two had earned enough to buy the whole Stratton franchise, renaming the company Stratton Oakmont. The company essentially functioned as a boiler room that marketed penny stocks and defrauded investors with pump-and-dump stock sales.

Stratton Oakmont did astonishingly well over the next several years, at one point employing over 1,000 stock brokers, and was linked to the IPOs of nearly three dozen companies. However, during his years at Stratton, Jordan Belfort led a life of lavish parties and intensive recreational drugs (especially methaqualone under the brand name “Quaalude”), which resulted in addiction.

Jordan Belfort’s famous sales pitch

Part of Belfort’s strategy was to teach his brokers his infamous sales pitch, the “ Kodak pitch ,” by which they were directed to cold-call clients and entice them with a trusted blue-chip company, only to then recommend stocks with higher margins for the seller, such as penny stocks.

The name came from using the blue-chip company Eastman Kodak as the bait. The goal of the pitch was solely to gain the client’s confidence in the trustworthiness of their firm by recommending a familiar household name that larger brokerage houses such as Merrill Lynch might recommend.

From there, the client would receive future updates on Eastman Kodak and new stock pitches involving a penny stock that Jordan Belfort was illegally manipulating and funneling money through. Unfortunately, the penny stocks often had little or no actual fundamental value and later crashed, obliterating the client’s investment while Belfort and his company pocketed millions. Naturally, during these events, Belfort claimed that he only tried to help his clients invest in the future of America.

Recommended video : “Don’t hang up until the client buys or dies”

Steven Madden, Jordan Belfort, and Stratton Oakmont

Steven Madden was introduced to Stratton by Danny Porush (the key partner at Stratton) and welcomed into the firm with a $500,000 early investment . Next, Stratton organized an IPO that gave themselves up to 85% (illegal as the underwriter of the public offering) of the company, subsequently dumping the shares almost right after the company went public to their clients, banking $20 million .

Madden eventually paid millions to the government and spent considerably more time (30 months) locked up in federal prison than Belfort (22 months).

The irony here is, however, though Steve Madden was taken public at a ludicrous valuation at the time (3 million shares worth $15 million), yet, as Madden writes in his memoir: “if you bought Steve Madden stock that day, even at the inflated price, and held onto it, you would be very rich today.”

Meanwhile, Eastman Kodak, the original blue chip company that served as bait to potential investors, has since filed for bankruptcy. Interestingly, in a twist of fate, the bait stock went bust, and the scam penny stock could have turned relatively small retail investors into millionaires today.

Jordan Belfort’s legal troubles

Law enforcement officials targeted Stratton Oakmont throughout its lifetime. Finally, in December 1996, the National Association of Securities Dealers (now the Financial Industry Regulatory Authority) expelled Stratton Oakmont, forcing it out of business. Jordan Belfort was subsequently indicted for securities fraud and money laundering in 1999.

Belfort’s demise can largely be attributed to his private attempts to move his money out of the U.S., smuggling it to Swiss bank accounts to be laundered. Eventually, however, the FBI agents (led by Greg Coleman and Joel Cohen) investigating Stratton and Belfort convinced witnesses to give them information about the move and were ultimately successful at also getting notoriously secretive Swiss banks to cooperate.

With solid evidence, both Belfort and Porush were arrested in September 1998 and convinced to collaborate with the investigation. Eventually, Belfort pleaded guilty, and after the case had taken years to come to trial, in 2004, he was convicted. However, Belfort ultimately served only 22 months of a four-year sentence at the Taft Correctional Institution in California in exchange for a plea deal with the FBI.

Jordan Belfort was ordered through his restitution agreement to pay 50% of his income until 2009 towards restitution to the 1,513 clients he had defrauded (totaling approximately $200 million in investor losses), with a total of $110 million in restitution further mandated. As late as 2013, complaints had been filed by federal prosecutors regarding his payments, leading to Belfort making a separate deal with federal authorities to complete the restitution payments.

During his time in prison, he shared a cell with comedian Tommy Chong, who encouraged him to tell the story of his experiences as a stockbroker. On his release in 2006, Belfort realized there was interest in his life story and so began pitching his manuscript, which eventually got picked up by Random House, who rewarded him with a $500,000 advance. “The Wolf of Wall Street,” the book that inspired the Jordan Belfort movie, was on bookshelves within a year of his release.

Chong and Belfort remained friends after their release from prison, with Belfort crediting him for his new career path as a motivational speaker and writer. Belfort commented on his wrong-doings in his memoir, stating:

“I got greedy. … Greed is not good. Ambition is good, passion is good. Passion prospers. My goal is to give more than I get, that’s a sustainable form of success. … Ninety-five percent of the business was legitimate. {…} It was all brokerage firm issues. It was all legitimate, nothing to do with liquidating stocks.”

Yet federal prosecutors and Securities and Exchange Commission (SEC) officials involved in the case maintain : “Stratton Oakmont was not a real Wall Street firm, either literally or figuratively.”

Jordan Belfort’s books

Belfort published two memoirs: “The Wolf of Wall Street” and “Catching the Wolf of Wall Street,” also issued in approximately 40 countries and translated into 18 languages. In 2017, Jordan Belfort released a self-help book, “Way of the Wolf.”

The former Federal prosecutor who led the investigation of Belfort has insisted that much in his memoirs is a fabrication embellished by aggrandization of his own persona and adoration by others and that “the real Jordan Belfort story still includes thousands of victims who lost hundreds of millions of dollars that they never will be repaid.”

Motivational speaking and sales training

Ultimately Belfort reinvented himself as a motivational speaker. When he first began speaking, he focused mainly on motivation and ethics in the financial world but then moved his focus to practical sales skills and entrepreneurship.

Recommended video: Jordan Belfort Reveals How To Sell Anything To Anyone At Anytime

The primary subject matter of his seminars is what he has referred to as the “Straight Line System,” a system of sales advice and persuasion skills, boldly stating : “You’re either a victim of circumstance or you’re a creator of circumstance.”

What is Jordan Belfort’s sales training about?

Jordan Belfort’s schemes explained

Let’s now briefly explain the various financial schemes, Jordan Belfort, together with Stratton Oakmont, partook in, including a boiler room and pump-and-dump operation, as well as money laundering.

Boiler room

A boiler room is an operation in which brokers apply high-pressure sales tactics to persuade investors to purchase securities with false or misleading premises. Most boiler room salespeople contact potential investors by cold calls. While this means the potential client has no reason to trust the caller, it also means they have no background information to refute their claims.

Part of the pressure sales approach includes making exaggerated assertions about the investment opportunity that the client cannot verify, encouraging the investor to buy the stock immediately. In addition, the salesperson might insist on immediate payment, including taking an aggressive approach and threatening the prospect to act, lest they “lose an opportunity of a lifetime.” In fact, promises of high returns and no risk are essential to pressuring clients to invest.

Boiler room scams typically sell fraudulent, speculative securities, typically penny stocks, i.e., small companies that trade for less than $5 per share. Penny stocks are too small for major stock exchanges and are only traded over-the-counter, meaning that a relatively small amount of buyers can cause a significant price rise.

In a typical penny stock scam, fraudsters would first accumulate a small-cap stock at a low price and then use boiler-room methods to gather buyers for an inflated price. In such a scam, victims may think they are buying on the open market when in reality, they are purchasing the shares directly from the scammers. The commission and the stock’s easy manipulation are the primary incentives for brokers to trade penny stocks.

Boiler room operations, if not illegal, unquestionably violate the rules of fair practice set forth by the National Association of Securities Dealers (NASD).

Pump and dump

Much like a boiler room operation, a pump-and-dump is a manipulative scheme to boost the price of a security through false, misleading, or greatly exaggerated statements. In a typical pump-and-dump, fraudsters use cold-calling, message boards, or social media to reach potential investors and convince them to buy the asset, with promises of guaranteed profits. Then, as the price rises, the scammers sell their shares, leaving investors holding the bag.

These schemes generally target micro- and small-cap stocks on over-the-counter exchanges that are less regulated than traditional exchanges as well as easier to manipulate. The practice is illegal based on securities law and can lead to heavy fines.

Money laundering

Money laundering is the illegal process of concealing the origin of money obtained from illicit activities, i.e., making “dirty” money appear legitimate. The method of laundering money typically involves three steps:

- Placement: Injecting the “dirty money” into a legitimate (cash-based) financial institution;

- Layering: Concealing the source of the funds through a series of transactions and bookkeeping tricks;

- Integration: Withdrawal of the “clean” money as needed.

For example, Belfort attempted a money laundering method known as “bulk cash smuggling,” based on moving “dirty” money, in its physical form, over the border to another country (in this case, Switzerland), where the bank secrecy laws are much more stringent.

Jordan Belfort’s boiler room

Ronald L. Rubin, the SEC enforcement attorney assigned to put together the case against Steven Madden, got a first-hand account from Jordan Belfort and Porush as “cooperating witnesses,” in which they explained the finer points of how they used their brokerage firm to steal millions of dollars from investors.

Rubin breaks Belfort’s signature fraud technique into five steps:

“1. Create IPO Stock;

2. Line Up the Victims;

3. Bait and Switch;

4. Market Manipulation;

5. Sell High and Shut the Door”.

Let’s summarize his findings outlined in the WSJ article.

1. Create IPO Stock

First, they needed a business to sell, and the definition of business, in this case, was very loose. What was required was not an actual business but rather a business entity with a story that could be transformed into publicly traded stock through a Stratton IPO.

Notably, the Stratton IPO stock was not actually sold to the public but to Stratton. To avoid securities laws that forbid underwriters from buying more than a small percentage of the IPO stock they issue, Stratton sold all of its IPO stock to friends (flippers), who immediately sold the stock back to Stratton for a small profit.

The IPO stock was typically issued to flippers at $4 per share and then sold back to Stratton for $4.25 per share – a lucrative deal for the flippers, who could pocket $50,000 from an IPO without risking a loss.

2. Line Up the Victims

Stratton’s brokers would first gain investors’ confidence by letting them make a small profit on one or two Stratton IPOs. Then, once trust had been established, the Stratton salesmen would inform these customers of a new hot IPO with a $4 issue price and wait for them to take the bait.

Like all Stratton IPOs, the stock’s price was expected to skyrocket after its release. So, for example, an eager customer with $100,000 of savings allocates the Stratton broker to purchase 25,000 shares of that IPO stock (with a $4 issue price) and then transfers the $100,000 to his Stratton account, offering Jordan Belfort and his cronies an exact picture of how much buying power they have.

3. Bait and Switch

Shortly before an IPO, the Stratton broker would call these customers and inform them that the IPO was so desirable that they could offer only a few shares at the $4 IPO price. However, the promise was still that they create purchase orders to be executed as soon as the stock began trading on the market, resulting in many customers assuming that such orders would result in stock purchases near the issue price ($4).

The pressure put on these investors was immense, especially since they had already consented to buy the same stock at the issue price, so they agreed to whatever was being shoved at them.

4. Market Manipulation

The company could have made millions just by selling its customers penny stocks for $4 per share, but after a few such IPOs, investors and regulators would have grown suspicious. So instead, Jordan Belfort used the stock market to disguise his fraud.

Let’s imagine Stratton issued one million shares of the IPO stock, but its customers had already pledged to purchase $12 million of the stock in the aftermarket.

The goal was thus to have the stock price rise from $4 to $12 per share before selling it to them. Then, having repurchased all of the IPO stock from the flippers, Belfort and Porush could cause the stock to trade in the aftermarket at any value. The simplest way to achieve that would have been to trade shares between Stratton accounts at increasing prices, but that would have been too conspicuous.

So instead, they had their flippers buy small amounts of stock using “market orders,” which buy shares at the lowest price offered by any seller. Of course, the only seller was Stratton Oakmont.

Flippers began placing these small market orders right when aftermarket trading kicked off on IPO day. At the same time, Stratton would sell its stock using “limit orders,” which offer stock for sale only above a fixed minimum price. After each of these sales, the firm would place another limit order with a slightly raised minimum price, resulting in the market orders executing at a higher price.

The market recorded a steady progression of trades at $4.25, $4.50, and $4.75, up to the $12 target price (all accomplished in mere minutes). And since this was the typical first-day trading pattern for legitimate hot IPO stocks during the 1990s, the manipulation wasn’t blatant.

5. Sell High and Shut the Door

When the IPO share price reached the $12 target, Stratton executed its customers’ buy orders. Had investors holding the inflated stock attempted to resell it quickly on the market, they would have found almost no genuine buyers, the stock price having nosedived about as fast as it had risen.

However, such an early price crash was rare for legitimate IPO stocks and would have drawn regulatory scrutiny and scared away future Stratton customers. To combat this, Stratton sustained the high price, typically for a month, by purchasing any of its IPO stock for sale on the open market.

Still, letting customers sell their stock for $12 while Stratton Oakmont was almost the only buyer would defeat the purpose of the scheme. So, investors had to be discouraged from selling too soon. This was done by showering more hyperbole onto customers who called to place sell orders (Stratton operated before online brokers, which enable investors to place their own orders).

Most sinister of all, if customers couldn’t be persuaded into holding on to their stock, their sell orders would simply be lost and their phone calls ignored. Or, when the sell orders were finally executed, the lack of buyers would cause the stock to crash, resulting in the customers’ funds being totally wiped out. But, of course, by that time, Belfort had the following IPO ready and was lining up new prey for his schemes.

Jordan Belfort in the “Wolf of Wall Street” movie

Based on Jordan Belfort’s memoir of the same name, “The Wolf of Wall Street” (2013) is a biographical black comedy crime movie directed by Martin Scorsese and written by Terence Winter, recounting Belfort’s perspective on his career as a broker in New York City.

In 2007, Leonardo DiCaprio and Warner Bros. won a bidding war for the rights to Belfort’s memoir, with Belfort banking $1 million from the deal.

“The Wolf of Wall Street” synopsis

After trying out a few entry-level jobs on Wall Street, Jordan Belfort, still in his 20s, decides to establish his own firm, Stratton Oakmont. With his trusted right-hand man and a motley crew of brokers, Belfort and his brokerage make an immense fortune by defrauding investors out of millions. However, while Belfort and his cronies indulge in a hedonistic concoction of sex and drugs, the SEC and the FBI gather evidence for his eventual comeuppance.

Recommended video: “ The Wolf of Wall Street” trailer

In conclusion

All in all, Belfort’s infamy has proved lucrative. He has picked himself up from the ruins of his fraudulent empire and built a brand new one by utilizing the media’s glorification and obsession with him as the embodiment of Wall Street greed.

FAQs about Jordan Belfort

Jordan Belfort is a former Wall Street stockbroker who, in 1999, was indicted for fraud and money laundering concerning his firm Stratton Oakmont’s market manipulation schemes that evaporated millions of investor dollars. Following his prison stint, Belfort transformed his image, becoming an acclaimed author and motivational speaker. His most notable work, “The Wolf of Wall Street,” chronicled his experiences and was subsequently adapted into a film by Martin Scorsese, with Leonardo DiCaprio in the lead role.

What did Jordan Belfort do?

Stratton Oakmount ran a boiler room to pump the value of penny stocks. Belfort’s brokers were trained to pressure inexperienced retail investors to buy shares of companies that Belfort owned, artificially inflating those stock prices and allowing Belfort to sell his shares at a high profit.

What Is a pump and dump scam?